- The Gross-to-Net Bubble Hit $175 Billion in 2019: Why Patients Need Rebate Reform (drugchannels.net)

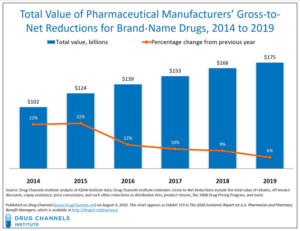

Last Friday’s Executive Orders revived the government’s effort to reform rebates in federal programs. Whether that effort succeeds, today's update reminds us what's still at stake in reforming rebates within the U.S. drug channel...For 2019, Drug Channels Institute estimates that the gross-to-net bubble—the dollar gap between sales at brand-name drugs' list prices and their sales at net prices after rebates and other reductions—reached $175 billion...The bubble reflects—and drives—many of patients’ problems and misunderstandings of U.S. drug prices...However, the political and practical challenges to rebate reform remain daunting. Few people grasp the complex economic interplay of patient out-of-pocket spending, cost-shifting, premiums, and payer incentives...READ MORE

- New fair price for Gilead’s remdesivir? Below $2,800 if dexamethasone lives up to its COVID-19 promise (fiercepharma.com)

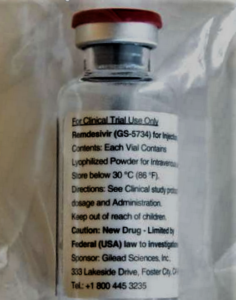

Gilead Sciences' remdesivir should be priced at no higher than $2,800 if peer-reviewed dexamethasone data support the steroid as the new COVID-19 standard of care, the Institute for Clinical and Economic Review says...Nearly two months ago, an influential drug cost watchdog pegged $4,460 as the fair price for Gilead Sciences’ authorized COVID-19 therapy remdesivir. But on coronavirus time, that's an eternity—and a lot has changed since then...In an updated assessment...the Institute for Clinical and Economic Review slightly dialed up its cost-effective price for remdesivir to a range of $4,580 to $5,080 based on detailed clinical data, updated cost estimates and interactions with Gilead...A recent announcement from U.K. researchers on the successful use of low-cost dexamethasone in a large COVID-19 clinical trial added another wrinkle to the price. That is, if the steroid’s benefits are confirmed in a peer-reviewed paper and therefore qualify it as the new standard of care, remdesivir’s cost should be cut to around $2,520 to $2,800, ICER said...READ MORE

- The top 15 (14) highest-paid biopharma CEOs of 2019 (fiercepharma.com)

Biotech and pharma companies are focused these days on delivering drugs and vaccines to fight the pandemic, but just a few months ago, they were recounting their 2019 accomplishments...While the world has changed for everyone—and drugmakers expect some financial pain this year—many enjoyed a productive year last year, with sales increases, new drug launches, M&A deals and plenty of clinical data. Those companies, and some with less stellar résumés, rewarded their CEOs handsomely for that work...Generally, a biopharma CEO's compensation derives from progress on several fronts, including R&D developments, as well as the usual revenue and stock price metrics...this year's roundup of biopharma’s best-paid CEOs...READ MORE

- Martine Rothblatt (United Therapeutics)

- Daniel O'Day (Gilead Sciences)

- Kenneth Frazier (Merck & Co.)

- Alex Gorsky (Johnson & Johnson)

- Richard Gonzalez (AbbVie)

- David Ricks (Eli Lilly)

- Robert Bradway (Amgen)

- Ludwig Hantson (Alexion Pharmaceuticals)

- Jeffrey Leiden (Vertex Pharmaceuticals)

- Giovanni Caforio (Bristol Myers Squibb)

- Heather Bresch (Mylan)

- Pascal Soriot (AstraZeneca)

- Michel Vounatsos (Biogen)

- Albert Bourla (Pfizer)

- Gilead to start selling remdesivir in coming weeks, expects ‘multi-year commercial opportunity’ (fiercepharma.com)ICER Presents Alternative Pricing Models for Remdesivir as a Treatment for COVID-19 (icer-review.org)

Gilead Sciences’ initial donation of remdesivir will be exhausted by early summer. The biotech will start charging for the drug in COVID-19 after that, and it might not be just a year or two of revenue flow...The company will pivot to a commercial plan after the donated supply of 1.5 million doses runs out around June or early July...The Institute for Clinical and Economic Review recently found remdesivir would be cost-effective at $28,670...But the U.S. drug cost watchdog argued that $50,000/QALY should be applied to remdesivir during a public health emergency. After that calculation, ICER pegged a reasonable price at $4,460...READ MORE

- Pfizer CEO says it’s ‘radical’ to suggest pharma should forgo profits on COVID-19 vaccine: report (fiercepharma.com)

Pfizer could make a 60% to 80% profit margin on its COVID-19 vaccine, one analyst estimates...Pfizer’s chief business officer John Young said the company wasn’t thinking about a return on investment for its rapidly developed COVID-19 vaccine. Instead, he said, “finding medical solutions to this crisis" was a Pfizer priority...But now that the company has moved into phase 3 trials of its BioNTech-partnered vaccine and scored a $1.95 billion supply deal with the U.S. government, Pfizer seems to be changing its tune....READ MORE

- ICYMI: Pharmacy benefit managers increasingly exclude medicines from formularies, restricting patient access (catalyst.phrma.org)

...CVS Caremark and Express Scripts, have once again increased the number of medicines on their standard formulary exclusion lists...As these PBMs control over half of the market combined, these changes have widespread implications for patients across the country...PBMs leverage their vast purchasing power and ability to exclude medicines from their standard formularies to negotiate large rebates and discounts from biopharmaceutical companies. PBMs then compel insurers and employers to use standard formularies by reducing the rebates offered to those who choose to adopt custom formularies without exclusions, which increases costs to the plan sponsor. In 2019, manufacturer rebates, discounts, fees and other price concessions grew to $175 billion. However, these rebates and discounts are typically not shared with patients at the point-of-sale...formulary exclusions can create additional barriers for patients who may experience challenges accessing prescribed treatments. These barriers to access can lead to health complications resulting from delayed treatment initiation or treatment disruption...READ MORE

- Taxpayers paid to develop remdesivir but will have no say when Gilead sets price (chron.com)

One drug that has shown promise for treating COVID-19 is remdesivir, an experimental antiviral product...The drug that buoyed expectations for a coronavirus treatment and drew international attention for Gilead Sciences, remdesivir, started as a reject, an also-ran in the search for antiviral drugs. Its path to relevance did not begin until Robert Jordan cleared it…To make progress, Gilead needed help from U.S. taxpayers. Lots of help. Three federal health agencies were deeply involved in remdesivir's development every step of the way, providing tens of millions of dollars of government research support. Now that big government role has set up a political showdown over pricing and access...federal agencies have not asserted patent rights to Gilead's drug, potentially a blockbuster therapy worth billions of dollars. That means Gilead will have few constraints other than political pressure when it sets a price in coming weeks..."Without direct public investment and tax subsidies, this drug would apparently have remained in the scrap heap of unsuccessful drugs...READ MORE

- How Hospitals and PBMs Profit—and Patients Lose—From 340B Contract Pharmacies (drugchannels.net)

The stunning growth of specialty pharmacies in the 340B Drug Pricing Program has accelerated a troubling trend: Patients covered by commercial insurance and Medicare Part D are footing the bill for 340B savings...That's the uncomfortable reality of the 340B program’s hidden prescription economics...Whenever a prescription is eligible for 340B pricing, an insured patient could pay thousands of dollars out of pocket—even as the 340B hospital and its contract pharmacy generate substantial profits. Meanwhile, private health plans and Medicare pay full price for drugs that are sold to 340B covered entities at deep discounts, further subsidizing hospitals and PBM-owned specialty pharmacies...340B Health, which lobbies for hospitals that participate in the 340B Drug Pricing Program, argues that the program “does not cost taxpayers any money.” Be wary of this misleading half-truth. The harsh reality is that patients and payers are funding the savings that flow back to 340B covered entities and their contract pharmacies...This fundamental unfairness is discussed rarely if ever. Rather than touting how hospitals spend their 340B savings, it’s time to start asking where those savings come from...READ MORE

- The latest: What they are saying: Intellectual property protections critical as we work to defeat COVID-19 (catalyst.phrma.org)

The U.S. biopharmaceutical industry depends on reliable intellectual property protections to promote the development of new treatments and cures for patients. Strong IP protections are especially important as innovators work around the clock making substantial investments at risk to develop solutions to help prevent infection and treat those with COVID-19...many of the existing medicines and investigational medicines in clinical trials for COVID-19 exist today because of IP and other incentives that drove their initial research...Strong and reliable IP protections support America’s robust innovation ecosystem by promoting innovation and affordability for patients who rely on new treatments and cures...READ MORE

- Copay Maximizers Are Displacing Accumulators—But CMS Ignores How Payers Leverage Patient Support (drugchannels.net)

Last week, the Centers for Medicare and Medicaid Services released its final Notice of Benefit and Payment Parameters for the 2021 benefit year...This final rule permits insurers to exclude the value of a pharmaceutical manufacturer’s copay support program from a patient’s annual deductible and out-of-pocket maximum obligations...Translation: CMS has confirmed that insurers have the option to use copay accumulator adjustment for their pharmacy benefit programs...Patients on specialty drugs lose big from accumulators, while plans profit from the lower spending that results. Consequently, copay maximizers have emerged as a more patient-friendly alternative to accumulators...Plan sponsors are publicly denouncing copay support programs—while they’re privately embracing them. CMS’s final rule ignores the troubling reality behind maximizers and accumulators: They encourage plans to use pharmacy benefit deductibles as a scheme that allows payers—not patients—to reap the greatest benefits from a manufacturer’s patient support program...READ MORE