- PBM Formulary Exclusions List Reaches All-Time High (drugtopics.com)

The number of drugs excluded from the three largest pharmacy benefit manager formularies reached an all-time high in 2023, despite concerns that profits are being put ahead of patient access. This year, CVS Caremark, Optum Rx and Express Scripts — which together handle 80% of all prescriptions in the United States — each have roughly 600 medications on their standard formulary exclusion lists...Exclusions leave patients with fewer options for treatment unless they can afford the out-of-pocket costs of buying drugs that are not covered by the insurer. What is even more disturbing are the trends within the trend of formulary exclusions, critics say,,,READ MORE

- Misdiagnoses in EDs lead to 250K deaths a year: study (fiercehealthcare.com)Diagnostic Errors in the Emergency Department: A Systematic Review (effectivehealthcare.ahrq.gov)

The care given in emergency departments came under fire yesterday with the release of a government study saying that 250,000 Americans die every year due to misdiagnoses...The findings spurred an immediate response from the president of the American College of Emergency Physicians, who questions the study’s veracity and methodology...Christopher S. Kang, M.D., president of the ACEP, said in a statement that “in addition to making misleading, incomplete and erroneous conclusions from the literature reviewed, the report conveys a tone that inaccurately characterizes and unnecessarily disparages the practice of emergency medicine in the United States.”...The study, conducted by Johns Hopkins for the Agency for Healthcare Research and Quality, states that among 130 million ED visits in the U.S. per year, 7.4 million patients are misdiagnosed. In addition, 2.6 million suffer an adverse event, and about 370,000 suffer serious harm from diagnostic errors...READ MORE

- Walgreens plots ‘aggressive’ strategy to build out healthcare services, CEO Roz Brewer says (fiercehealthcare.com)

On the heels of several high-profile acquisitions, Walgreens aims to be a point of entry for consumers for healthcare services ranging from urgent care to specialty care and even in-home health...Walgreen's VillageMD unit recently announced it was buying another urgent and primary care chain, Summit Health-CityMD, in a deal worth close to $9 billion. The VillageMD-Summit Health deal will expand Walgreen's reach into primary, specialty and urgent care. Combined, VillageMD and Summit Health will operate more than 680 provider locations in 26 markets...READ MORE

- How the Biosimilar Boom Boosts Drug Wholesalers’ Profits (drugchannels.net)

The biosimilar boom for provider-administered drugs continues to accelerate. Net prices in therapeutic classes with biosimilar competition have declined by 60% or more over the past few years. Some major biological reference products have now lost a majority of their unit sales to their biosimilars...this accelerating adoption also boosts profits for pharmaceutical wholesalers and specialty distributors—particularly when these channel participants can influence which biosimilar version a provider utilizes...READ MORE

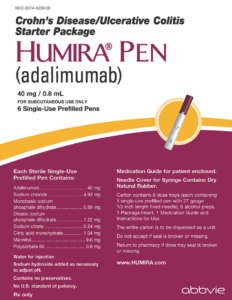

- How a Drug Company Made $114 Billion by Gaming the U.S. Patent System (dnyuz.com)AbbVie’s global bestseller to face knockoffs starting this week (msn.com)

In 2016, a blockbuster drug called Humira was poised to become a lot less valuable...Through its savvy but legal exploitation of the U.S. patent system, Humira’s manufacturer, AbbVie, blocked competitors from entering the market. For the next six years, the drug’s price kept rising. Today, Humira is the most lucrative franchise in pharmaceutical history...Next week, the curtain is expected to come down on a monopoly that has generated $114 billion in revenue for AbbVie just since the end of 2016. The knockoff drug that regulators authorized more than six years ago, Amgen’s Amjevita, will come to market in the United States, and as many as nine more Humira competitors will follow this year from pharmaceutical giants including Pfizer. Prices are likely to tumble...READ MORE

- The return of rep access: Report suggests bounce-back in rate of pharma-friendly docs (mmm-online.com)Veeva Pulse Field Trends Report (veeva.com)

Pharma rep access to HCPs across specialties rose to an average of 60% in the U.S., from a 20% low during the pandemic...The increasing number of clinicians willing to meet virtually has driven the rate of rep-friendly physicians to a record high of 60% in the U.S...That figure, a cross-specialty tally, is up from an average of about 20% during the COVID-19 pandemic. The report shows the extent to which in-person visits, long a staple of the typical drugmaker’s marketing playbook, have been complemented by virtual meetings in the engagement mix. With more than half of all accessible physicians using video in combination with in-person, video is supporting its offline cousin, not supplanting it...READ MORE

- Biotechs reveal layoffs, research revamps in third quarter earnings (biopharmadive.com)

Third quarter earning reports have brought news of layoffs from at least six biotechnology companies this week as a weak market continues to weigh on smaller drugmakers...Through Wednesday, Tricida, Freeline Therapeutics, Harpoon Therapeutics, Adamis Pharmaceuticals, Neoleukin Therapeutics and NexImmune have all announced workforce reductions. The cuts range from 30% of employees at NexImmune to 57% of staff at Tricida, putting scores of workers out of a job...READ MORE

- U.S. new drug price exceeds $200,000 median in 2022 (reuters.com)

After setting record-high U.S. prices in the first half of 2022, drugmakers continued to launch medicines at high prices in the second half, a Reuters analysis has found, highlighting their power despite new legislation to lower costs for older prescription products...The median annual price of the 17 novel drugs the U.S. Food and Drug Administration approved since July 2022 is $193,900, down from $257,000 in the first half of 2022...For full year 2022, the median was $222,003...The latest numbers imply double digit year-over-year price growth...READ MORE

- Inflation Reduction Act and Its Impact on Pharmaceutical Pricing and Investment Decisions (drugtopics.com)

The reference to “maximum fair price” in the act bodes poorly for manufacturers and suggests more of a take-it-or-leave-it situation rather than a negotiation where clinical evidence would be the prevailing factor in determining price...Now that the dust has settled over enactment of the Inflation Reduction Act, leaders across the industry should be taking stock and assessing how the law will impact their product portfolios and the bottom line. Although several open questions remain, pharmaceutical manufacturers can take actions to best position their organizations to either benefit from — or mitigate repercussions — of the new law. Specifically, executives should lay out strategies for addressing revenue optimization, evidence development planning and portfolio optimization...READ MORE

- CVS reports $3B loss to cover global opioid settlement but Q3 earnings beat Wall Street estimates (fiercehealthcare.com)

CVS reported a quarterly loss of more than $3 billion to cover its share of a global opioid settlement, but its third-quarter earnings blew past Wall Street estimates...The pharmacy retail giant said that it had a $5.2 billion charge in the third quarter for a settlement relating to its role in the opioid crisis. The settlement resolves "substantially all opioid lawsuits and claims filed by other states, political subdivisions and tribes against the company to be paid over 10 years, beginning in 2023...READ MORE