- Angered by Walgreens deal, Express Scripts blocks access to Valeant’s Glumetza (fiercepharma.com)

PBM giant Express Scripts has long been a leader in the fight to tamp down drug prices, and now, it's using its formulary power to freeze out a diabetes drug from controversial Valeant...The company will exclude the Canadian drugmaker's Glumetza--an extended-release, brand-name version of generic med metformin--as soon as copycats become available on Feb. 1...Valeant hiked the price of Glumetza by more than 800% in 2015, Express Scripts says; as of July 31, the drug's list price stood at $10,020 for 90 tablets, up from $896 in January 2013..."By excluding Glumetza from these formularies, Express Scripts clients are ensuring that their patients be dispensed the more affordable generic formulation of metformin,"...noting that "branded Glumetza will not be allowed to process" under any circumstances.

- JP Morgan 2016: Why the Anthem, Express Scripts kerfuffle could be massive headache for all PBMs (firstwordpharma.com)

Anthem CEO Joseph Swedish caused a bit of a stir at an otherwise tame JP Morgan Healthcare Conference this month when he essentially accused Express Scripts...of overcharging his managed care organisation by $3 billion per year...the public spat represents a serious headache for Express Scripts, and could result in an unexpected windfall for one of the company’s main competitors, but in a broader sense the episode highlights what one industry expert believes is an increasingly important market inefficiency that would – if exposed to and by payers – have massive implications for the PBM sector...Politicians (and plenty of others) have been raising hay lately about the need for...more transparency...this same thought process has not (yet) been extended into the PBM space, where companies’ primary role is that of a middleman...“I hope it erupts into more – this is serious and real. PBMs...make price transparency for pharmaceuticals impossible and it is the patient that suffers the most because of it,”...“The thing centres on the fact that the PBMs insist on large rebates from the manufacturers, and the amounts are ‘proprietary’ so they can conceal them from their clients. The discounts aren’t being passed along to their customer but the effect is to force list prices higher to maximise rebates,”...more transparency could be a big benefit for drugmakers, who are likely well aware of the situation but feel as though their hands are tied when it comes to fighting back. “I believe that the more this gets pushed, and the more others learn about it, they will have to have this extend further,”...“Pharma has to have this revealed by others – they can’t complain because the PBMs could retaliate” during the formulary negotiation process.

- Anthem Takes $3 Billion Express Scripts Fight Public (bloomberg.com)

Health insurer Anthem Inc. wants $3 billion a year more in savings on drugs from Express Scripts Holding Co., and is threatening to ditch the company in a move that would depose the pharmacy benefit manager as the country’s biggest...The insurer, which contracts with Express Scripts to manage prescription drug costs for its members, said the pharmacy manager should be passing along about $3 billion a year more in the savings it negotiates from drug companies... The two may be running out of time. “We have a very involved dispute resolution process in the contract that has been fully exhausted”...Anthem took the dispute public because the company wasn’t getting the savings it needed to offer more competitive products, such as Medicare drug plans..."Both of us have to step back and see whether we’re honoring the contractual terms of the agreement"...If not, “you have your legal remedies.”

- Annual Specialty Therapies Conference; Jan. 28-29 | Planet Hollywood | Las Vegas, NV (drugchannels.net)Effectively Managing Specialty Therapies a Forum for Payers 2016 (cbinet.com)

CBI’s Specialty Therapies Forum, the conference that brings together healthcare and pharmaceutical thought leaders to share best practices for managing specialty therapies…an opportunity to discuss not only strategies for managing the cost of specialty therapies, but also to provide the latest information and case studies dedicated to ensuring access and quality care in specialty benefit management. New to the agenda this year is a workshop dedicated to Specialty Pipeline Management.

Dialogue led by key thought leaders:

Avella Specialty Pharmacy | Blue Cross Blue Shield of Massachusetts | Blue Cross and Blue Shield of Minnesota | Blue Cross and Blue Shield of North Carolina | Denver Health Medical Plan | Fairview Specialty Pharmacy | Florida Blue | Gorman Health Group | Horizon Blue Cross Blue Shield New Jersey | Independent Health | NSHOA Cancer Centers in NY | Rutgers RWJ Medical School | Walgreens | Walmart | Widener University

- Payers see price leverage with entry of Merck hepatitis C drug (reuters.com)

...pharmacy benefit managers expect the launch of Merck & Co Inc's new hepatitis C pill to improve their leverage in price negotiations with drugmakers...The Food and Drug Administration...approved Merck's Zepatier (elbasvir and grazoprevir) for treatment of patients infected with the most common form of the liver-destroying virus, genotype 1, as well as the less common genotype 4...The list price for the new drug is $54,600 for a 12-week regimen - compared with $94,500 for Gilead Sciences Inc's Harvoni. A multi-pill regimen, Viekira Pak, from AbbVie Inc has a list price near $83,000..."We look forward to working with Merck," Express Scripts said..."Having multiple, clinically effective options allows us to again leverage competition and make medicine more affordable for our clients while ensuring appropriate patient access."..."Given Merck's interest in participating in such a large market, we model and fully expect increased price competition and we also view Merck's list price as a rational way to stay out of the drug pricing spotlight,"...

- Solving the Mystery of Employer-PBM Rebate Pass-Through (drugchannels.net)

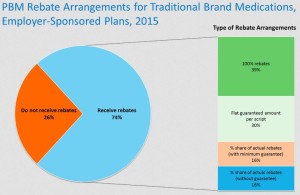

Manufacturers pay billions in rebates to pharmacy benefit managers (PBMs). How much of that money do PBMs share with their plan sponsor clients...As far as I know, the only public answer comes from the Pharmacy Benefit Management Institute’s new 2015-2016 Prescription Drug Benefit Cost and Plan Design Report (Free download with registration)...According to the PBMI’s survey data, only three-quarters of employers directly receive a piece of manufacturer rebates. Some employers get 100% of the rebates. Others get a portion, sometimes with a guaranteed minimum amount...I also highlight PBMI data about the prevalence of spread pricing (as opposed to pass-through pricing) as a means for employers to compensate PBMs. Despite what you may have heard, many employers still seem to prefer spread pricing models...

- WellCare makes CVS Health its pharmacy benefit manager (reuters.com)

Health insurer WellCare Health Plans said it would change its pharmacy benefit manager to CVS Health Corp from UnitedHealth Corp's Optum Rx, effective Jan. 1...About 3.8 million WellCare members enrolled under its Medicaid, Medicare and prescription drug plans will be able to access CVS' pharmacy network, WellCare said on Thursday...CVS is the second-largest U.S. pharmacy benefit manager and drugstore.

- Express Scripts sued by compounding pharmacies for alleged antitrust practices (statnews.com)

For the second time since Express Scripts began blocking coverage of hundreds of ingredients used to make compounded medicines, several compounding pharmacies have filed a lawsuit accusing the pharmacy benefits manager of using illegal tactics...In the latest instance, a half-dozen compounding pharmacies have charged Express Scripts with violating antitrust laws and is attempting to force them out of business...Express Scripts has taken “a series of unreasonable restrictions and rules that would make it impossible for [the compounding pharmacies] to fill prescriptions” for patients “and obtain reimbursements that would cover their costs,”...The company and the other benefits managers “employed tactics designed to ensure that the compounding pharmacy industry …cannot survive.”...The move to cut back on covered ingredients has riled compounding pharmacies...the Food and Drug Administration has cracked down on compounding pharmacies by increasing the number of inspections, and, in rare cases, taking legal action to halt allegedly unsafe practices. The justifiable emphasis on safety has forced many compounding pharmacies to enhance operations...The compounding pharmacies are striking back. In November 2014, three others filed a lawsuit claiming Express Scripts illegally blocked legitimate prescriptions and unfairly forced patients to seek more expensive medicines or simply not seek treatment. The pharmacies maintained the benefits manager violated federal law because it lacks authority to essentially alter terms of health plans.

- Major drugmakers push back in U.S. price debate (reuters.com)

With a backlash brewing over the price of medicines in the United States, drugmakers are pushing back with a new message: Most people don't pay retail...Top executives from Eli Lilly and Co, Merck & Co and Biogen Inc said in interviews...this week that the media focus on retail, or "list prices," for branded medications is misplaced...They stressed that the actual prices paid by prescription benefit managers, insurers and other large purchasers are reduced through negotiated discounts...But the industry practice of raising prices each year for treatments used by millions of people is attracting new attention...the industry needs to better explain the value of drugs and how they can prevent healthcare costs down the line...We have to explain the difference between the list price and the net price…Drugmakers keep actual pricing details close to guard their position in negotiations with commercial insurers and government health plans like Medicaid. There is no centralized catalog of U.S. list prices or rebates for medicines...U.S. health insurers say that, even accounting for discounts, drug prices are rising at an unsustainable rate, and they are pressuring drugmakers for cuts.

- Managed Care Pharmacy Resident Q&A (pharmacytimes.com)Have you ever wondered what opportunities exist for pharmacists in managed care organizations?...To find out, I spoke with Alex Wiggall, PharmD, a managed care pharmacy resident at Horizon Blue Cross Blue Shield of New Jersey in Newark...Dr. Wiggall grew up in the Philadelphia area before graduating with his Doctor of Pharmacy degree from University of Maryland School of Pharmacy. After completing his residency, he hopes to find a job at a health plan in the New York City area.

- Why did you decide to pursue a managed care residency?

- What is the structure of your residency?

- What are your day-to-day tasks?

- How did you decide that your residency program was the right fit for you?

- What career opportunities does a pharmacy resident have after completing a managed care program?

- What advice do you have for students looking to pursue a residency in managed care?