- U.S. seeks to ‘onshore’ drug production in response to COVID-19. Is pharma even interested? (fiercepharma.com)

With the COVID-19 pandemic shining a spotlight on the global pharmaceutical supply chain, U.S. legislators have put forward a raft of legislation that would seek to "onshore" drug manufacturing at the expense of major producers abroad...Guess who's wary of that proposal? Big Pharma...the White House is reportedly working on a "Buy American" executive order that would require government agencies to purchase American-made medical products, and that order could eventually include pharmaceuticals...the Pharmaceutical Research and Manufacturers of America...has pushed back against Congressional support for a supply chain shake-up...Manufacturing stateside would likely cost a princely sum compared with the cheaper wages and lower costs abroad, and would upset the balance of pharma's global supply chain..."While we support efforts to foster more manufacturing in the United States, moving all manufacturing here is impractical and likely not feasible," a PhRMA spokesperson said in an email. "Policymakers must take a long-term, more holistic look at global pharmaceutical manufacturing supply chains before jumping to rash proposals that may cause significant disruptions to the U.S. supply of medicines."...READ MORE

- 7 Medical Conditions That Will Be Lining Big Pharma’s Pockets by 2020 (fool.com)

Big pharma stands to make hundreds of billions of dollars from a handful of medical conditions.

- No. 7: Viral hepatitis - $45 billion and $55 billion will be spent globally on drugs that treat viral hepatitis by 2022...around 257 million have chronic hepatitis B virus infection and 71 million people have chronic hepatitis C virus infection.

- No. 6: Respiratory diseases - treating respiratory diseases are expected to generate between $53 billion and $56 billion in sales by 2020. The most common respiratory diseases include asthma, allergies, and chronic obstructive pulmonary disease.

- No. 5: Autoimmune diseases - Autoimmune disease medications could make big pharma companies between $55 billion and $65 billion by 2020

- No. 4: Cardiovascular diseases - cardiovascular disease drugs will rack up sales between $73 billion and $76 billion by 2020...Cardiovascular drugs include treatments for hypertension, heart disease, and cholesterol.

- No. 3: Pain - Pain medications are projected to be the third-biggest moneymaker by 2020, with sales of $82 billion to $85 billion...drugs includes treatments for musculoskeletal pain, arthritis, anesthesia, analgesics (both narcotic and non-narcotic), and migraine.

- No. 2: Diabetes - diabetes drugs are expected to be near the top in spending, with projected global sales between $107 billion and $113 billion by 2020

- No. 1: Cancer - The top medical condition that will likely line big pharma's pockets by 2020 is cancer…sales of cancer drugs will be between $100 billion and $120 billion

- Big Pharma Share Buybacks Not Impacting R&D Budgets (forbes.com)Big Pharma Spends on Share Buybacks, but R&D? Not So Much (nytimes.com)

In her Sunday business column in the New York Times, Gretchen Morgenson went after Big Pharma and the propensity for companies to buy back shares of their own stocks. Entitled "When Big Pharma Spends, Research Isn’t No. 1," Morgenson focuses on an academic study that concludes that "from 2006 through 2015, the 18 drug companies in the Standard & Poor’s 500 index spent a combined $526 billion on buybacks and dividends"--an amount that exceeded by 11% the companies’ R&D spending of $465 billion during these years...Morgenson further quotes the authors: "But there is really very little drug development going on in companies showing the highest profits and capturing much of the gains." The implication is pretty clear: drug companies blame high drug prices on the high costs of R&D, but this is a canard. They spend more money on buying back their stock. Needless to say, industry critics have seized on this as yet another reason why the biopharmaceutical industry can’t be trusted. Unfortunately, the article is misleading.

- The First CAR-T Drugs Have Left the Gate (fool.com)

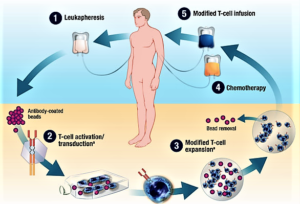

Investors should keep an eye on this promising way to treat cancer...For all the talk about biotechs being nimble, it's a big pharma that looks like it'll be the first company to launch a chimeric antigen receptor T-cell (CAR-T) product...Novartis announced last week that the Food and Drug Administration accepted its application to market tisagenlecleucel-T...in patients with B-cell acute lymphoblastic leukemia who are relapsed and refractory to other therapies...A few days later, Kite Pharma completed its application for axicabtagene ciloleucel...Kite's application could be accepted early, putting it less than two months behind Novartis…Since CAR-T therapies are personalized treatments that have to be made individually for each patient, they're likely to be expensive to produce and therefore require a premium price. The first company to get a CAR-T therapy approved will set the price, which later companies may have to match unless they can justify a higher price with higher efficacy...With prices that will probably exceed those of current cancer treatments, investors should expect some pushback from insurers. One way Novarits and Kite can get around the cost issue is by offering money-back guarantees...Kite's and Novartis' CAR-T therapies are just the tip of the iceberg for this new way to treat cancer...

- The People vs Big Pharma: tackling the industry’s trust issues (pharmaceutical-technology.com)

Price hikes, manipulative patent litigation and a rampant opioid addiction epidemic have steadily soured the public’s view of the pharmaceutical industry. Does Big Pharma has (have) a crisis of public trust on its hands, and if so, how might it restore its credibility in the eyes of patients, policymakers and the rest of the taxpaying public?...“I sort of view Big Pharma, as an industry, as an octopus with many tentacles, and at the end of every tentacle is a wad of cash,” says David Mitchell, president...of...Patients for Affordable Drugs...“It reaches into academic medical centres, professional organisations, patient organisations, state houses, campaigns, Congress – they’re everywhere.”...Mitchell’s description sounds more suited to some sinister political conspiracy than an industry whose business is saving lives and curing diseases. But despite the pharma sector’s noble clinical goals, many of the industry’s business practices – monopoly pricing, blocking generics and biosimilars, spending heavily on political lobbying, an arguably relentless focus on profit – have eroded public trust in its credibility and motives.

- Survey data confirms pharma’s trust issues

- Pharma trust: a varied global picture

- Particular challenges in the US

- Trust exercises: the road to redemption

- Half of Americans Tested Misused Prescription Medications, Lab Tests Show (ptcommunity.com)

Quest Analysis of 3.4 million tests shows evidence of dangerous drug combinations...A majority of test results from patients taking prescription medications show signs of drug misuse—including potentially dangerous drug combinations...The Quest Diagnostics Health Trends study is based on analysis of the company's de-identified laboratory data, believed to be one of the largest nationally representative datasets of objective laboratory information of patients prescribed opioids and other commonly abused medications. Physicians order laboratory services to aid their ability to monitor patients for signs of prescription or illicit drug misuse or abuse...(The report, "Prescription Drug Misuse in America: Diagnostic Insights in the Growing Drug Epidemic")

- evidence of misuse has declined in recent years, 52% of test results showed evidence of potential misuse in 2016, suggesting a majority of patients took their prescribed drugs in ways that were inconsistent with their physician's instruction...

- disturbing patterns of concurrent drug use. Among more than 33,000 specimens tested for opioids, benzodiazepines, and alcohol in 2016, more than 20% were positive for both opioids and benzodiazepines, more than 10% were positive for both opioids and alcohol, and 3% were positive for all three...

- 19% of specimens positive for heroin in 2016 were also positive for nonprescribed fentanyl...

- drug misuse rates were high among most age groups and both genders. However, adolescents (10 to 17 years of age) showed a striking improvement, with the rate dropping from 70% to 29% between 2011 and 2016...

- Misuse rates were higher for men and women of reproductive age (58%) than in the general study population (52%)

- Industry paid $8.2B to docs, hospitals last year (biopharmadive.com)

Drug and device makers collectively made nearly $8.2 billion in payments to physicians and teaching hospitals in the U.S. last year, according to data made public by the Centers for Medicare and Medicaid Services last week...Payments for research made up more than half of the total, which also includes money given to doctors and hospitals for expenses like travel, gifts, speaking fees and meals. The $8.2 billion recorded last year was a notch higher than 2015's total and $320 million more than 2014's figure...Among the ranks of big pharma...Roche spent the most — a princely $586 million in payments. Novartis and Pfizer were close behind with more than $475 million each, although both made more research-related payments than Roche did...The data gives a snapshot of the enormous sums of money paid by the drug and device industries to doctors and hospitals. Most of the money goes towards research, payments for things like enrolling patients into new clinical studies or study implementation. Research payments can also include direct compensation to doctors…CMS began tracking payments in 2013 as part of changes to federal law through the Affordable Care Act, with 2016 marking the third full year of the program...

- Why can’t the drug industry solve its gender diversity problem? (cen.acs.org)

Women and men enter the workforce with advanced degrees in medicine and science at nearly the same rate, but for some reason, many more women either drop out or hit a plateau in their careers...Whether it is the paucity of women on company boards, the slow progress in getting women into leadership positions at big pharma, or the alarming absence of women as scientific founders and research heads, the numbers just aren’t there...organizations have amped up the number of initiatives meant to help women ascend the ranks. Networking for women, board training for women, mentorships for women—programs have proliferated...But are they actually moving the needle on gender diversity in biotech?...To try to answer that question, C&EN talked with nearly two dozen women working in the biosciences—in academic drug discovery, biotech start-ups, and big pharma...Some are optimistic that women entering the workforce now will be the true beneficiaries of a society that values an inclusive work culture. Others worry that change is simply too slow or unfolding in a way that doesn’t get at the fundamental reasons so many women drop out of the pipeline...

- Trump’s FDA Commissioner on Drug Prices, Regulations, Science (bloomberg.com)

Trump vs. Big Pharma: Can He Bring Drug Prices Down?...U.S. Food and Drug Administration Commissioner Scott Gottlieb spoke with Bloomberg News about drug pricing, new medicine and regulations. This transcript of the interview has been edited for clarity and length.

- What’s the FDA’s role to play in drug pricing and what can the agency do, given that it hasn’t traditionally had a mandate to address the issue?

- Is it just small, opportunistic drug companies that are "gaming" the system, or is this something bigger companies do as well?

- What about the rest of the administration? Trump talked a lot about drug pricing on the campaign trail and after, yet we haven’t seen much action other than yours.

- What about an executive order on drug pricing -- there was talk that Trump was going to come out with something. Is that still being worked on?

- What about drugs like EpiPen, would you come out with new rules there to create more competition? [EpiPen, made by Mylan NV, is what’s known as a drug-device combination, where both the medicine and the device that administers it can have patent protections.

- But is it reasonable to assume you’re looking at doing something like this, on these types of devices?

- One of the things we’ve seen from the administration is, get rid of regulation, get rid of regulation, get rid of regulation. How does your philosophy as a regulator –- one of the biggest regulators in the U.S. government –- how does that line up with what the Trump administration has called for?

- Some of the things you’re doing to create more competition among drugs, people could interpret as a loosening of standards. I wonder if you think that’s the case?

- Through the years we’ve seen the agency go through cycles, of pushing drugs out into the market faster, versus being much more conservative about safety. Is the balance at the FDA changing?

- How broadly can you apply new standards or guidelines for drug approval? There’s been talk about it in cancer, but what about other diseases?

- Big Pharma faces $26.5B in losses this year as next big patent cliff looms, analyst says (fiercepharma.com)

With 18 branded drugs on the line, patent losses this year could jeopardize $26.5 billion in annual sales from Big Pharma, projected to be the biggest fall-off until at least 2025…Which companies are at risk? Roche, GlaxoSmithKline, Eli Lilly, Pfizer and AstraZeneca to name a few...This year's potential patent expiry damage is much more daunting than 2015 and 2016, when only four and nine meds from companies...lost exclusivity, respectively...Anticipated expirations for 2017 include Roche’s Rituxan, GSK’s Advair, Eli Lilly’s Humalog and Cialis, AstraZeneca’s Byetta, Pfizer’s Viagra and Merck’s Vytorin...the 2017 patent losses and associated sales declines will "continue to pressure growth" in the industry...about 45% of the sales at risk looking forward are for biologics, which will face biosimilar competition rather than generics..."erosion rates will be slower," but still "unpredictable.