- How Mergers Will Affect Pharmacists (drugtopics.com)

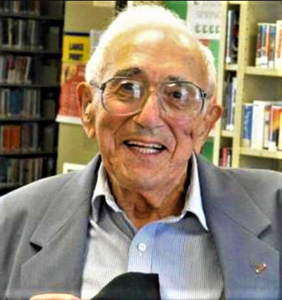

The Cigna-Express Scripts merger has gotten a go-ahead from the Department of Justice, but DOJ has not ruled on the CVS-Aetna merger at press time...Both deals have shareholder backing... I think it’s part of an overall trend...Effects on Pharmacists...Frederick S. Mayer...CEO of Pharmacists Planning Services Inc...fears that they could result in loss of pharmacy jobs due to closures of independent pharmacies that can no longer compete. Chain pharmacists could also have less job security as locations may close. Mayer also says consolidation could lead to higher prices, lower quality, and less choice for consumers...Pharmacists...trained eight years for their PharmD, and now they are counting, pouring, and typing due to mergers,” says Mayer, who adds that pharmacists in larger settings don’t have adequate time for patient counseling...Over the past 10 years, mergers have resulted in poorer choices of medication for consumers and patients...Chains that are in one of these vertically integrated systems have guaranteed volume without competition on price...Perry Cohen, CEO of The Pharmacy Group...Companies responding to the need for new care models for healthcare services. The marketplace needs new care models and wants to embrace these companies that get ahead of the curve...More Mergers Coming... more vertical mergers and acquisitions...The horizontal is being driven a lot by the reimbursement pressure...The vertical is much more strategic around the control of the overall person’s healthcare...

- Four Fun Facts About the Walgreens-Rite Aid Merger Agreement (drugchannels.net)Sec. and Exch. Com. Form 8-K AGREEMENT AND PLAN OF MERGER Among WALGREENS BOOTS ALLIANCE, INC., RITE AID CORPORATION (files.shareholder.com)

Late last week, Walgreens Boots Alliance filed an 8-K with the full text of its merger agreement with Rite Aid….The document containing the Agreement and Plan of Merger weighs in at a hefty 137 pages. Below, I highlight four fun facts about the deal’s timing, its termination fees, and what the companies will do to achieve antitrust approval.

- The deal must be completed before Halloween 2016.

- If Rite Aid backs out of the deal, then it owes as much as $370 million to Walgreens Boots Alliance.

- WBA could owe Rite Aid a termination fee as large as $650 million.

- To get the deal approved, WBA is willing to dump as many as 1,000 stores.

- Senators call for scrutiny of Walgreens-Rite Aid deal (reuters.com)

Two influential senators called for close scrutiny of Walgreens Boots Alliance Inc's plan to buy Rite Aid Corp for $9.4 billion, a deal that would unite two of the three biggest U.S. drugstore chains...Walgreens Chief Executive Stefano Pessina said the company had analyzed the antitrust aspect of the deal but would not speculate on the number of drugstores it might need to divest in order to win regulatory approval...The top two antitrust lawmakers in the Senate...urged antitrust enforcers to give the plan careful scrutiny because of the importance of healthcare in the U.S. economy..."I have fought tirelessly to promote competition in the health sector and I believe the proposed merger of two of the three largest drug store chains in the country raises serious issues," Senator Amy Klobuchar...on the Senate Judiciary Committee's antitrust subcommittee...subcommittee's chair...Senator Mike Lee, said he hoped antitrust agencies would "closely scrutinize" the deal....

- Investigating the mystery of soaring generic medication prices (theguardian.com)

Without more transparency on how such financial decisions are made…Americans may be doomed to see more generics zoom up in price… under the terms of my insurance with Blue Cross Blue Shield of Rhode Island, it will cost me $85.54. That’s a 232% price increase for…a drug that has been on the market for about 90 years… Americans spend significantly more for prescription medications than do citizens of any other developed nation. We do so directly, through higher prescription costs, and indirectly, as high drug costs drive up our insurance premiums and our taxes, via higher Medicaid and Medicare costs…negotiations between the industry and insurers feature "no transparency"…The bad news? The situation could get worse, and affect more drugs, more insurance companies and more consumers, as consolidation in the pharmaceutical industry reduces the number of potential rivals in the generic drug field.

- A Vital Drug Runs Low, Though Its Base Ingredient Is in Many Kitchens (nytimes.com)Answer to Drug Shortages (nytimes.com)

Hospitals around the country are scrambling to stockpile vials of a critical drug — even postponing operations or putting off chemotherapy treatments — because the country’s only two suppliers have run out...The medicine? Sodium bicarbonate solution..."As I talk to colleagues around the country, this is really a problem we’re all struggling with right now," said Mark Sullivan, the head of pharmacy operations at Vanderbilt University Hospital and Clinics in Nashville...Hospitals have been struggling with a dwindling supply of the medicine for months...Pfizer, has said that it had a problem with an outside supplier but that the situation worsened a few weeks ago. Pfizer and the other manufacturer, Amphastar, have said they don’t know precisely when the problem will be fixed, but it will not be before June for some forms of the drug, and in August or later for other formulations...Without an abundant supply of sodium bicarbonate, some hospitals are postponing elective procedures or making difficult decisions about which patients merit the drug...The situation with sodium bicarbonate solution appears to have begun in February when Pfizer, the main supplier, announced it was in short supply...the problem had worsened just after Pfizer went from shipping its generic injectable products from five regional warehouses to one national distribution center, part of a reorganization after its acquisition of the drugmaker Hospira...

- Walgreens Store Sales Seen as Hurdle for Rite Aid Approval (bloomberg.com)

Walgreens Boots Alliance Inc.’s deal to acquire Rite Aid Corp. is expected to draw antitrust scrutiny not only because the company would grow to 12,700 locations, but because of what goes on behind the scenes with drug payments…Federal Trade Commission…will look closely at whether the merging of the No. 1 and No. 3 pharmacy chains in the U.S. will lead to higher prices for prescription drugs...the FTC will probably review the approximately $9.4 billion deal market-by-market instead of on a national basis, since CVS, Walgreens, Wal-Mart and Rite Aid together control only about half of the U.S. retail pharmacy market...The rest is held by independent stores, smaller chains and mail-order companies. Walgreens is likely to sell or shutter some stores...

- Walgreens Boots Alliance to Buy Rite Aid for $17.2 Billion (bloomberg.com)Walgreens’ Q4 profit beats Street; yearly sales top $103 billion (drugstorenews.com)

Walgreens Boots Alliance Inc. agreed to acquire Rite Aid Corp. for about $9.4 billion in cash… The…deal…would combine the second- and third-largest drugstore chains in the U.S., with a total of about 12,800 locations, helping Walgreens vault past market leader CVS Health Corp. The acquisition will… will produce more than $1 billion in savings from cost overlaps…the deal is valued at $17.2 billion… Rite Aid shares fell 8.1 percent to $7.97 at 9:55 a.m. in New York, below Walgreens’ offer of $9 a share, reflecting speculation that the transaction will face antitrust scrutiny…Walgreens shares slumped 6.6 percent to $88.90. The deal creates financial savings but does little to change the drugstore chain’s strategic position in the rapidly evolving health-care industry…

- 2015: The Health Care Year in Review (commonwealthfund.org)

When it comes to historic changes in the U.S. health care system, few years could compete with 2014, but 2015 gave it a run for its money. With 2016 knocking at the door, it’s time to take a look back and round up the biggest health care events of the year.

- The health spending slowdown ends.

- Rx pricing lands in the spotlight.

- The insurance expansion presses on…

- …But the pay-fors take a hit.

- Consolidation reshapes the health care landscape.

- Collapse of the CO-OPs.

- Health care politics mellowing?

- Rates of hospital-acquired conditions remain low.

- Mortality is rising for white, middle-aged Americans.

Despite the year’s ups and downs, it’s clear that the insurance expansions continued to make a big impact in the lives of Americans in 2015. Here’s to a new year in which we continue to make coverage gains—and make inroads on issues such as drugs spending and broader economic inequality.

- The Walgreens-Rite Aid Deal: Ten Things You Should Know (drugchannels.net)

Wow. Walgreens Boots Alliance is acquiring Rite Aid. As I told The New York Times: “The pharmacy consolidation endgame has begun.”…Given the consumer angle, the deal has been widely covered.

Here are two significant news reports that outline the transaction’s high points:

- Walgreens to Buy Rite Aid for $9.4 Billion in The New York Times

- Walgreens, Rite Aid Unite to Create Drugstore Giant in The Wall Street Journal

..here are the surprisingly skimpy official company documents:

- Press release…

- Fiscal year end 2015 and 4Q earnings conference call (See page 19.)

The deal was not a total surprise. In April, I asked Will Walgreens Boots Alliance Buy Rite Aid?

- WBA is doubling down on retail pharmacy.

- Surprisingly, WBA is claiming that mega-scale with payers did not drive the deal.

- Envision Rx is a learning opportunity, not a strategic driver.

- The FTC will approve the deal.

- The deal adds even more complexity and opacity to WBA.

- It’s good for AmerisourceBergen, but horrible for McKesson.

- Wholesaler outsourcing will make integration easier.

- WBA will (probably) proceed with its ABC warrants.

- All hail our global channels overlord.

- Big deals beget more deals.

- Walgreens Said to Near Deal for Rite Aid (nytimes.com)Walgreens-Rite Aid Deal Fits Stefano Pessina's Plan Under Obamacare's Squeeze (forbes.com)Why Walgreens Is Close to Spending Billions to Gobble Up Rite Aid (thestreet.com)

Rite Aid had a market value of about $6.4 billion before news reports of merger talks...Walgreens Boots Allianceis near a deal to buy Rite Aid....potentially uniting two of the country’s biggest drugstore chains…meaning a takeover could be worth more than $8 billion after a likely premium from Walgreens. Rite Aid also has $7.4 billion of debt…would create a new pharmacy giant with heightened influence with drug makers, pharmacy benefit managers and others in the health care industry.