- Pharmacies miss half of dangerous drug combinations (chicagotribune.com)

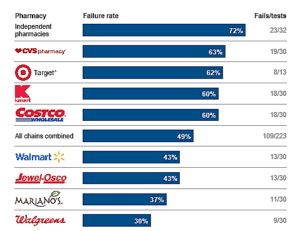

In the largest and most comprehensive study of its kind, the Tribune tested 255 pharmacies to see how often stores would dispense dangerous drug pairs without warning patients. Fifty-two percent of the pharmacies sold the medications without mentioning the potential interaction, striking evidence of an industry-wide failure that places millions of consumers at risk...CVS...had the highest failure rate of any chain in the Tribune tests, dispensing the medications with no warning 63 percent of the time. Walgreens...had the lowest failure rate at 30 percent — but that's still missing nearly 1 in 3 interactions... There is a very high sense of urgency to pursue this issue and get to the root cause...test after test, other pharmacists dispensed dangerous drug pairs at a fast-food pace, with little attention paid to customers. They failed to catch combinations that could trigger a stroke, result in kidney failure, deprive the body of oxygen or lead to unexpected pregnancy with a risk of birth defects...The Tribune study...exposes fundamental flaws in the pharmacy industry. Safety laws are not being followed, computer alert systems designed to flag drug interactions either don't work or are ignored, and some pharmacies emphasize fast service over patient safety. Several chain pharmacists, in interviews, described assembly-line conditions in which staff hurried to fill hundreds of prescriptions a day.

- U.S. probes contracts between drugmakers, pharmacy benefit managers (reuters.com)

The U.S. Attorney's Office...is investigating contracts between drugmakers and companies that manage prescription benefits...Federal prosecutors have approached at least three companies, including Johnson & Johnson, Merck & Co and Endo International Plc, demanding information about their contracts with pharmacy benefit managers...Pharmacy benefit managers...which administer drug benefits for employers and health plans and also run large mail-order pharmacies, have been challenging the rising cost of new medications...When drugs are knocked off their formularies, patients may have to pay full price for them. PBMs often keep or dump a product depending on whether they can obtain favorable pricing.

- Few Consequences For Health Privacy Law’s Repeat Offenders (propublica.org)HIPAA Helper - Who is Revealing Your Private Medical Information? (projects.propublica.org)HHS - OCR - Breach Portal: Notice to the Secretary of HHS Breach of Unsecured Protected Health Information (ocrportal.hhs.gov)

Repeat HIPAA Violators - These health providers have the most privacy complaints that resulted in corrective-action plans or “technical assistance” being provided by the OCR from 2011 to 2014.

Regulators have logged dozens, even hundreds, of complaints against some health providers for violating federal patient privacy law. Warnings are doled out privately, but sanctions are imposed only rarely. Companies say they take privacy seriously...CVS is among hundreds of health providers nationwide that repeatedly violated the federal patient privacy law known as HIPAA between 2011 and 2014...Other well-known repeat offenders include the U.S. Department of Veterans Affairs, Walgreens, Kaiser Permanente and Walmart...I don’t like the idea of repeat offenders not being called to task for that behavior and I would like to see us doing more in this regard...The number of health information privacy complaints submitted to the Office for Civil Rights within the Department of Health and Human Services has increased dramatically in recent years, in part because of the introduction of an online complaint portal...Using data provided by OCR under the Freedom of Information Act, ProPublica is launching a new tool, HIPAA Helper, which allows users to look up reports of privacy violations by provider for the first time. OCR’s material often referred to the same entities by multiple names. CVS was listed as “CVS,” “Pharmacy, CVS,” “Caremark, CVS,” “CVS Caremark”...We have standardized organizations’ names to make searching easier.

- Four Fun Facts About the Walgreens-Rite Aid Merger Agreement (drugchannels.net)Sec. and Exch. Com. Form 8-K AGREEMENT AND PLAN OF MERGER Among WALGREENS BOOTS ALLIANCE, INC., RITE AID CORPORATION (files.shareholder.com)

Late last week, Walgreens Boots Alliance filed an 8-K with the full text of its merger agreement with Rite Aid….The document containing the Agreement and Plan of Merger weighs in at a hefty 137 pages. Below, I highlight four fun facts about the deal’s timing, its termination fees, and what the companies will do to achieve antitrust approval.

- The deal must be completed before Halloween 2016.

- If Rite Aid backs out of the deal, then it owes as much as $370 million to Walgreens Boots Alliance.

- WBA could owe Rite Aid a termination fee as large as $650 million.

- To get the deal approved, WBA is willing to dump as many as 1,000 stores.

- Homeopathic Medicines Will Carry Labels Saying They’re Unscientific (slate.com)

The Federal Trade Commission just cracked down on an unusual product that has long enjoyed exemption from regulation: homeopathic drugs. Available everywhere...homeopathic products are advertised as an effective way to treat a wide range of conditions...Americans spend over $3 billion a year on homeopathy, and the market appears to be growing steadily...companies selling these products have never been required to show they are effective at doing what they claim...the FTC announced its “enforcement policy statement” about homeopathic product labeling...the recommendations are pretty minimal...the agency produced a report that concluded customers were likely to be deceived by labels that did not carry the appropriate disclaimers, and therefore disclaimers stating that these products are untested will now be required. The requirement is not technically a law like…The rules require packaging to effectively communicate two key disclaimers:

- “There is no scientific evidence that the product works.”

- “The product’s claims are based only on theories of homeopathy from the 1700s that are not accepted by most modern medical experts.”

- Prescription drug roundup is today 10AM-2PM (kolotv.com)

On April 30th, 2016, local and federal agencies will once again partner together to sponsor the Prescription Drug Round Up event in Washoe County. Since the area’s first event in the fall of 2009, the Round Ups in Washoe County have collected over 1.6 million prescription pills. More than 230,000 of those pills were in categories that are commonly diverted and abused, such as painkillers, depressants and stimulants...Medications – including household prescription and over the counter pills and liquids – can be dropped off at the Round Up event with no questions asked. Citizens are asked to bring medications in their original containers if possible, and may mark out the patient’s name if they wish. Prescription waste or expired/surplus medications from medical offices or pharmaceutical companies or their representatives are not accepted at this event. In addition, volunteers from Northern Nevada HOPES and the Northern Nevada Outreach Team will be collecting residential sharps and providing information to the community about proper syringe disposal...Round Up Locations April 30th 10:00am – 2:00pm:

- Raleys - 18144 Wedge Parkway, Reno

- Walgreens - 10370 N. McCarran Blvd, Reno

- Save Mart– 4995 Kietzke Lane, Reno

- CVS - 680 N. McCarran Blvd, Sparks

- CVS – 5151 Sparks Blvd, Sparks

- Walmart – 250 Vista Knoll Parkway, Reno

- Incline Village Community Hospital – 880 Alder Ave, Incline Village

- Big Pharma gets data for discounts (politico.com)

Attention patients! The side effects of your discounted drugs may include drowsiness, nausea — and a loss of privacy...Drug companies are increasingly offering price discounts and subsidies to patients in exchange for their medical data. The details of that exchange can be easy to miss: They're in the fine print...As the frequency of such arrangements grows, along with the price of certain drugs, the deals are causing discomfort about the uses of intimate health details by drug companies...Such programs are part of a growing appetite for patient data in the health care sphere among pharmacies, pharmacy benefit managers, app makers and others. Walgreens and CVS both have begun offering customer goodies in exchange for personal data...Pharmacies across the US are dangling perks to coax their customers to relinquish all sorts of personal data about their health...Companies use data to understand how a drug is performing across a population, but also to gain insight for marketing to, or communicating with individual patients...

- Six Retail Chains Now Dominate the Still-Booming 340B Contract Pharmacy Business (drugchannels.net)

The pharmacy industry’s role in the 340B Drug Pricing Program continues to expand...latest analysis finds that nearly 18,000 pharmacy locations contract with 340B-eligible covered entities. That accounts for more than one in four U.S. retail, mail, and specialty pharmacy locations...Walgreens remains the biggest player, with about the same number of locations as those of Walmart, CVS, Rite Aid, Kroger, and Albertsons combined...Amidst the contract pharmacy boom...what’s really going on. How many prescriptions do contract pharmacies provide at discounted prices to uninsured, underinsured, and low-income patients? Who is really benefiting from the contract pharmacy business?…a 340B contract pharmacy doesn’t earn traditional spreads and dispensing fees. They instead profit from fees paid by the 340B entity. Given providers’ substantial profit opportunities, a 340B entity can afford fees that often far exceed a pharmacy’s typical profits from dispensing a third-party-paid prescription...There are many other profit opportunities...The extensive use of 340B contract pharmacies allows hospitals and other providers to benefit from 340B drug discounts earned from commercially paid prescriptions dispensed by contract pharmacies...Do needy patients benefit? No one knows. Covered entities are not specifically obligated to share any 340B savings with financially needy or uninsured patents, nor are they required to disclose how they use profits from the 340B program...

- Pricing Power – Big pharmacies are dismantling the industry that keeps US drug costs even sort-of under control (qz.com)

When US lawmakers convened a hearing last month to discuss the pricing of prescription drugs, it was the testimony of Martin Shkreli...that garnered the headlines. But the hearing also looked at an issue that...could make drugs more expensive for far more people…The impetus was October’s announcement from Walgreens...that it was buying Rite Aid...Critics said that would create a drugstore duopoly with CVS, the market leader. They didn’t, however, look as hard at another effect of the deal, which likely will bring about the final collapse of the industry tasked with keeping prescription-drug costs under control...Buried inside Rite Aid is a bundle of pharmacy benefit managers...Walgreens says that acquiring Rite Aid’s PBMs would help it compete with arch-rival CVS, which controls a large and extremely profitable PBM called Caremark...combining pharmacies and PBMs under one roof creates a conflict of interest. It can restrict patients’ access to certain prescription drugs, and can prevent independent drugstores from competing fairly for new customers...As "competition decreases,"..."prices are going to increase. That’s what we’re finding now." If Walgreens successfully acquires Rite Aid and its PBMs, one of the industry’s last remaining constraints on drug prices will disappear.

- U.S. drug benefit managers clamp down on specialty pharmacies (reuters.com)

...the largest U.S. managers of private prescription drug benefits have cut off at least eight pharmacies that work closely with drugmakers, intensifying scrutiny of a system that helps inflate drug prices…The terminations come from payers who together manage drug benefits for more than 100 million Americans…Express Scripts, the nation's largest pharmacy benefits manager, has changed the algorithms it uses in its audits to find pharmacies focused heavily on one drug manufacturer and has cut ties with half a dozen such pharmacies...Independent pharmacies and their drugmaker partners counter that Express Scripts, CVS and OptumRx together control more than two-thirds of the market through their own mail-order operations. The specialty pharmacies say that the benefit managers are trying to curb the explosive growth of smaller, independent players.