- Aetna, Humana terminate $37 billion merger (chaindrugreview.com)

After being blocked by a federal court, Aetna Inc. and Humana Inc. have decided to terminate their $37 billion merger deal...The health insurance giants said...that, with the move, Aetna will pay Humana a $1 billion breakup fee...In January...the...District Court for the District of Columbia ruled in favor of the Department of Justice’s request to enjoin the Aetna-Humana merger. The government claimed that the combination of the two health insurers would lessen competition, harming seniors who buy private Medicare coverage and some consumers who buy health insurance on public exchanges...The consolidation wave hitting the health insurance sector has been seen as a byproduct of the Affordable Care Act. The mega-deals would provide fast access to the millions of people who have gained health coverage under the ACA and would be a vehicle for capturing Medicaid business, which has expanded dramatically under the health reform law...the climate for mergers and acquisitions in the health care sector has become uncertain. Besides the DOJ’s opposition to the mega-mergers, the Trump administration and Republican leaders in Congress have begun efforts to dismantle the ACA. That has cast a cloud on the health insurance marketplace, since it remains unclear what would replace the ACA and how consumers who have obtained coverage via the exchanges would continue to receive benefits.

- These 10 S&P 500 Health Care Companies Are the Most Shareholder Friendly (thestreet.com)

Which health care companies have traditionally been the most shareholder friendly? Turns out Pfizer…is one of them. But what about the rest of the sector?...Health care companies have been actively returning capital to shareholders over the past 10 years, but not all of its sub-industries were active participants. However, that may change, particularly as several biotech companies start to mature…"Biotech has been increasingly active in repurchasing shares during the past five years,"…."We expect these trends to continue in the next several years, and we anticipate that more biotech companies will engage in similar capital deployment activities in the future as their businesses mature and they begin generating steady cash flows. Although we do not anticipate biotech to overtake the pharmaceutical industry."…So which health care companies have led the way with the most returned capital to shareholders over the past 10 years? Here's the list..

- Pfizer Inc.; Pharmaceuticals; YTD return: 3.3%; TRC 2005-2014: $127.37 billion

- Johnson & Johnson; Pharmaceuticals; YTD return: -2%; TRC 2005-2014: $108.4 billion

- Merck & Co. Inc.; Pharmaceuticals; YTD return: -4.7%; TRC 2005-2014: $68.1 billion

- Amgen Inc.; Biotech; YTD return: 0.39%; TRC 2005-2014: $39.56 billion

- United Health Group Inc.; Managed Health Care; YTD return: 11.7%; TRC 2005-2014: $36.27 billion

- HCA Holdings Inc.; Health Care Facilities; YTD return: -8.1%; TRC 2005-2014: $33.54 billion

- Abbott Laboratories; Health Care Equip ; YTD return: 2.2%; TRC 2005-2014: $33.16 billion

- Anthem Inc.; Managed Health Care; YTD return: 4.5%; TRC 2005-2014: $33.11 billion

- Bristol-Myers Squibb Co.; Pharmaceuticals; YTD return: 14.9%; TRC 2005-2014: $27.6 billion

- Medtronic Plc ; Health Care Equip ; YTD return: 4.7%; TRC 2005-2014: $24.4 billion

- Why hackers are going after health-care providers (washingtonpost.com)

Washington is reeling from the news of a hack at MedStar, one of the largest medical providers in the area. A computer virus infecting the organization's computer systems forced MedStar to shut down much of its online operations...The exact nature of the attack is not yet known, but MedStar is just the latest victim in a string of cyberattacks that have hit the health-care industry hard. Here's what you need to know about how health-care providers became the latest digital battleground.

- Why would cybercriminals go after the health-care industry?

- Just how vulnerable is the health-care sector to cyberattacks?

- What is the health-care sector doing to fix all this?

- Four Fun Facts About the Walgreens-Rite Aid Merger Agreement (drugchannels.net)Sec. and Exch. Com. Form 8-K AGREEMENT AND PLAN OF MERGER Among WALGREENS BOOTS ALLIANCE, INC., RITE AID CORPORATION (files.shareholder.com)

Late last week, Walgreens Boots Alliance filed an 8-K with the full text of its merger agreement with Rite Aid….The document containing the Agreement and Plan of Merger weighs in at a hefty 137 pages. Below, I highlight four fun facts about the deal’s timing, its termination fees, and what the companies will do to achieve antitrust approval.

- The deal must be completed before Halloween 2016.

- If Rite Aid backs out of the deal, then it owes as much as $370 million to Walgreens Boots Alliance.

- WBA could owe Rite Aid a termination fee as large as $650 million.

- To get the deal approved, WBA is willing to dump as many as 1,000 stores.

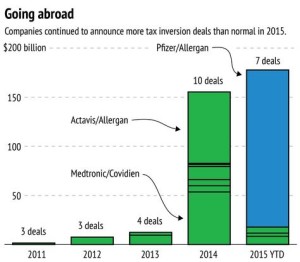

- Data: Tax inversions still going strong as M&A weakens (cnbc.com)

Pfizer's record-setting proposed purchase of Allergan for about $160 billion will not only be the biggest health-care sector deal ever, it will also be one of the largest tax inversions in recent history…Tax inversions...are frowned upon by politicians and the Treasury Department. But efforts to penalize companies for making such deals seem to be falling flat…Tax inversions are a better deal for companies that already have substantial sales abroad, or (like pharmaceuticals) rely on high-margin businesses based on intellectual property…while inversions have continued at an unusually high rate, overall merger and acquisition activity has been slowing…By value, U.S. inversion deals accounted for about 4 percent of global M&A activity in 2014 and 2015 — up from 2 percent or less in the three years before that…It remains to be seen whether Treasury Department rules meant to prevent tax inversions will have an impact. The regulations do not apply to the Pfizer deal, which will result in a company with about 56 percent ownership in the U.S. — the rules only apply to companies with 60 percent or higher.

- Walgreens Store Sales Seen as Hurdle for Rite Aid Approval (bloomberg.com)

Walgreens Boots Alliance Inc.’s deal to acquire Rite Aid Corp. is expected to draw antitrust scrutiny not only because the company would grow to 12,700 locations, but because of what goes on behind the scenes with drug payments…Federal Trade Commission…will look closely at whether the merging of the No. 1 and No. 3 pharmacy chains in the U.S. will lead to higher prices for prescription drugs...the FTC will probably review the approximately $9.4 billion deal market-by-market instead of on a national basis, since CVS, Walgreens, Wal-Mart and Rite Aid together control only about half of the U.S. retail pharmacy market...The rest is held by independent stores, smaller chains and mail-order companies. Walgreens is likely to sell or shutter some stores...