- Amid Opposition, Rite Aid Issues Shareholder Plea To Vote For Albertsons Deal (forbes.com)

Rite Aid executives issued an unusually lengthy plea for shareholders to vote in favor of its merger with Albertsons amid opposition by some investors who’ve been trying to derail the deal...Before shareholders is a $24 billion merger with grocery store giant Albertsons announced in February that would result in Rite Aid shareholders owning about 30% of the combined new company. The combination of Rite Aid, which operates RediClinic, and Albertsons would create a company with 319 health clinics and 4,345 pharmacies after the merger closes...Some investors were upset that senior executives will be paid retention bonuses even if the deal falls through. Others were upset that Rite Aid isn’t getting a higher price, especially as pharmacy benefit managers are suddenly an acquisition target and shareholders see value in Rite Aid’s PBM, EnvisionRxOptions, which has been growing rapidly...

- Gilead’s educational campaign boosted HCV diagnosis rates for baby boomers (mmm-online.com)

...Gilead Sciences told investors...that an unbranded campaign encouraging baby boomers to get tested for hepatitis C helped boost screening and diagnosis numbers, which in turn upped sales of its HCV therapies...The drugmaker markets several blockbuster HCV therapies, including Sovaldi and Harvoni. It most recently received FDA approval for Vosevi…About nine million people underwent testing for hepatitis C in 2016, up 15% compared to 2015's testing rates...This led to about 190,000 new diagnoses in 2016, a 32% increase compared to 2015...Gilead's unbranded campaign targeting baby boomers launched in October...We always feel that part of our role in the areas...that we operate is to provide education...Gilead reported that its HCV franchise generated sales of $1.9 billion in the second quarter of 2017, down 17% from the same quarter in 2016. But sales increased over the first quarter of the year, driven partly by patient starts...

- Legal pot growers to drive up California warehouse rates (reuters.com)

Legalizing recreational marijuana in California is creating a gold rush for a decidedly less intoxicating sector: warehouses in which to grow the plants...Investors have few options to cash in directly on the state's recent decision to legalize the drug, as there are no publicly traded cannabis producing companies and marijuana remains illegal under federal law. However, they are anticipating a lift in demand for warehouses as legal pot companies search for space to grow their supply...Shares of industrial warehouse companies such as Prologis Inc, Rexford Industrial Realty Inc and Terreno Realty Corp that have significant exposure to the California market should benefit even if they do not lease to marijuana companies directly…cannabis companies are expected to pay above-market rates for older, outmoded facilities that are more suitable for growing plants indoors and storing products containing marijuana, taking out some of the vacancy in an already-tight market and pushing overall rents higher...Cannabis companies are going to find some distressed properties and get them up and running, and in many cases they will have the capital to pay whatever it takes to get space...

- Pharma companies turn to LinkedIn to engage (mmm-online.com)

While the three granddaddy social networks, Facebook, Twitter and YouTube, have spent a decade publicly duking it out for share of human attention-span and commercial usefulness, LinkedIn has quietly and efficiently evolved to become an essential pillar of corporate practice, for individuals and organizations alike...LinkedIn has been something of an enigma and part of the reason has been the difficulty of pinpointing its core purpose. For a long time, it was seen as a professional advancement network, crudely dubbed “Facebook for jobs.” But while career advancement and recruitment is still a major function, over time LinkedIn has evolved into an effective publishing platform for professional content, which has had profound implications for corporate communications and marketing activities...A big part of LinkedIn's appeal lies in the high level of engagement of its members and the potential for precise targeting of content...In the healthcare space, membership encompasses all stakeholder groups: pharma companies, patients, healthcare professionals, marketing agencies, hospitals, investors and, of course, employees...The evolution of LinkedIn...to a publishing platform has had a profound effect on social-media responsibilities within pharma organizations...LinkedIn is now a fully fledged communications vehicle...Regulatory considerations are obviously paramount with any pharma-generated social-media activity...

- Big-name tech investors pour millions into marijuana — both medicinal and not (statnews.com)

The storied Silicon Valley venture firm Benchmark Capital has launched a slew of tech companies: Twitter, Uber, Snapchat, Instagram. Now its search for the next big thing has led it to…pot...Benchmark recently invested $8 million in Hound Labs, a startup here in Oakland that’s developing a device for drivers — and law enforcement — to test whether they’re too buzzed to take the wheel...Wealthy investors are pouring tens of millions into the cannabis industry in a bid to capitalize on the gold rush that’s expected when California legalizes recreational marijuana on Jan. 1. They’re backing development of new medicinal products, such as cannabis-infused skin patches; new methods for vaporizing and inhaling; and “budtender” apps like PotBot, which promises to scour 750 strains of cannabis and use lab research, including DNA analysis of each strain, to help customers find the perfect match...Among the noted investors: tech and biotech mogul Peter Thiel, who co-founded PayPal and made a fortune with the cancer drug startup Stemcentrx. Thiel contributed $300,000 to the California ballot campaign that paved the way for legalization. And in the first public endorsement of the industry from a major biotech investor, Thiel’s Founders Fund has sent millions to Privateer Holdings, a Seattle private equity firm that backs research into medical marijuana products, among other cannabis-related ventures...

- ‘Pharma bro’ Martin Shkreli heads into fraud trial (reuters.com)‘Pharma Bro’ defies advice to keep quiet before fraud trial (cnbc.com)

Martin Shkreli, the pharmaceutical entrepreneur vilified as the "pharma bro" for raising the price of a life-saving drug by 5,000 percent, will go on trial...for what U.S. prosecutors called a Ponzi-like scheme at his former hedge fund and a drug company he once ran…The charges that led to his arrest in December 2015...focus on Shkreli's management at Retrophin and the hedge fund MSMB Capital Management between 2009 and 2012...Prosecutors said Shkreli lied about MSMB's finances to lure investors and concealed devastating trading losses from them. They said he paid the investors back with money stolen from Retrophin…

- Pharma relying more on non-GAAP accounting and the SEC is noticing (fiercepharma.com)

Valeant Pharmaceuticals got chastised by the SEC this year for its use of non-GAAP (Generally Accepted Accounting Principles) accounting to make its performance look better than it might have actually been, one in a long list of issues that are dogging the company. But Valeant is far from the only pharma company playing a little loose with the rules and the trend is getting worse, even as investors and the SEC are watching more closely...GAAP accounting was developed so investors can get an apples-to-apples comparison of how companies are doing quarter to quarter and year after year. But some companies are not all that crazy that the rules make it harder to make themselves look good to investors. Companies have been using non-GAAP measurements, sometimes on individual line items, and the SEC has been taking note...the SEC updated guidance on the use of non-GAAP reporting, detailing how it should and--more importantly--shouldn’t be used...

- 5 Trends influencing drug pricing (biopharmadive.com)

It started the same way many things have in recent memory, with a tweet...Hillary Clinton’s...Twitter account..."Price gouging like this in the specialty drug market is outrageous. Tomorrow I'll lay out a plan to take it on."...Recognizing the risks that such reforms would pose to drugmaker revenue, investors quickly sold off millions of shares in pharmaceutical companies. The iShares Nasdaq Biotechnology exchange-traded fund, which shows levels of biotech investments, sunk more than 6%…the biopharma industry could see just how much was at stake if it left pricing backlash unchecked. Still, the problem persisted...In response to the pushback, drugmakers have adopted a few key strategies...reactions to those initiatives have been mixed at best, with many viewing them as skin-deep remedies rather than the panacea needed to substantively solve drug pricing. Though a cure-all isn’t on the horizon, five key trends are currently shaping drug pricing decisions:

- Targeted legislation

- New models

- Rare disease and specialty drug development

- Negotiating power

- High-deductible insurance plans

- The First CAR-T Drugs Have Left the Gate (fool.com)

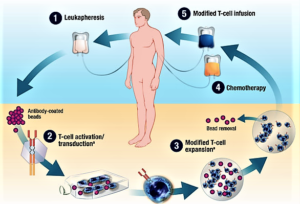

Investors should keep an eye on this promising way to treat cancer...For all the talk about biotechs being nimble, it's a big pharma that looks like it'll be the first company to launch a chimeric antigen receptor T-cell (CAR-T) product...Novartis announced last week that the Food and Drug Administration accepted its application to market tisagenlecleucel-T...in patients with B-cell acute lymphoblastic leukemia who are relapsed and refractory to other therapies...A few days later, Kite Pharma completed its application for axicabtagene ciloleucel...Kite's application could be accepted early, putting it less than two months behind Novartis…Since CAR-T therapies are personalized treatments that have to be made individually for each patient, they're likely to be expensive to produce and therefore require a premium price. The first company to get a CAR-T therapy approved will set the price, which later companies may have to match unless they can justify a higher price with higher efficacy...With prices that will probably exceed those of current cancer treatments, investors should expect some pushback from insurers. One way Novarits and Kite can get around the cost issue is by offering money-back guarantees...Kite's and Novartis' CAR-T therapies are just the tip of the iceberg for this new way to treat cancer...

- Valeant slashes financial outlook; investors flee ‘a broken company’ (statnews.com)

After years of enviable growth and brash moves, Valeant Pharmaceuticals appears to be succumbing to a broken business model...The beleaguered drug maker held a lengthy and much-anticipated briefing...for investors, and the news wasn’t pretty — the company cut its 2016 revenues and earnings forecast more than expected and disclosed weakness in areas of its business that caught investors by surprise. Particularly disturbing is the possibility that Valeant is in danger of defaulting on some of its debt...Valeant stock plunged 48 percent during the day on huge trading volume, continuing a slide that began last fall amid accusations by short sellers that the company had improperly booked revenue and used a specialty pharmacy to manipulate insurance reimbursements for key products. Even before the conference call ended, some Wall Street analysts recommended that investors flee.