- Drug Makers Dismiss Outrage over High Prices as ‘Abomination’ (realclearhealth.com)

The protesters carried handwritten signs accusing drug maker Gilead Sciences of greed for pricing its breakthrough hepatitis C drug at $84,000 per treatment...a Gilead executive was asked how he lives with himself...the executive vice president for corporate and medical affairs, joked that he goes running...the drug industry’s biggest showcase, the J.P. Morgan Healthcare conference...As executives and investors shuttled from meeting to meeting, seeking deals, many dismissed public outrage at the industry as misguided...Public anger at drug companies is “an abomination,” Ron Cohen, chairman of the big industry group BIO, said at the Biotech Showcase...All the talk about pharma profiteering, Cohen said, is “a perversion of reality.”...Outside the stately old hotel where the...conference is being held, a handful of protesters marched with signs declaring “Gilead = Greed,” “Public Health Not Private Wealth,” and “Jail Gilead Drug Profiteers.”...“If Gilead’s approach is the future of how blockbuster drugs are launched in America, it’s going to cost billions and billions of dollars to treat just a fraction of patients in America,” Senator Ron Wyden said...

- Fading Obamacare Gains Put Drag on 16% Hospital Muni-Bond Rally (bloomberg.com)More Than Half of Obamacare's Co-Ops Have Now Failed -- Here's Why You Should Care (fool.com)5 States Where the Affordable Care Act Risks Becoming Unaffordable (fool.com)

For municipal-bond buyers, the boost from Obamacare is waning…municipal bonds have rallied, delivering 16 percent returns in the past two years as the providers were stuck with fewer unpaid bills…“The effect of the Affordable Care Act is fading,”… “We don’t really have any new states adopting Medicaid so you don’t have that expansion.”…The federal law has provided health-care coverage to 17.6 million Americans as a majority of states expanded access to the Medicaid program for the poor and others bought subsidized insurance. The factors that have driven that growth are now weakening…while rising premiums may cause some consumers to go without or lose their policies for not paying their bills…About 9.9 million people were paying for coverage purchased on the exchanges created by the law as of June 30, a decline of 300,000 from March 31…Department of Health & Human Services estimates that about 9.1 million people will be enrolled by the end of the year…“It’s very safe to bet that a lot of hospitals across the country are not going to see as many people getting insurance as they had expected,” The law…has been a boon to investors who hold tax-exempt bonds sold by hospitals: The securities have delivered outsized returns since then, beating a dozen other revenue-bond sectors, including toll roads, airports and utilities…The bonds’ prices have slipped 0.4 percent over the past month amid speculation that the Federal Reserve will raise interest rates as soon as December.

- Valeant CEO Michael Pearson Sells 1.3 Million Shares After Margin Call On $100 Million Loan (forbes.com)

J. Michael Pearson, the embattled CEO of Valeant Pharmaceuticals , came under a different kind of pressure Thursday after weeks of battling allegations of accounting impropriety and usurious business practices. Pearson was forced to sell 1.3 million Valeant shares yesterday after facing a margin call from Goldman Sachs on a $100 million loan…The margin call stems from a sharp plunge in the value of Valeant shares over the past three months as the company faced scrutiny from lawmakers into its drug pricing practices, and surprised investors by disclosing a web of consolidated specialty pharmacies it uses to distribute drugs. Valeant’s shares were battered a week ago after large pharmacy benefit managers refused to accept orders from its specialty pharmacies, and Pearson had no choice but to cut ties with the operations…The plunge, it turns out, only added to the company’s woe.

- California adopts tough rules for antibiotic use in farm animals (reuters.com)

California Governor…Brown…signed a bill that sets the strictest government standards in the United States for the use of antibiotics in livestock production…. comes amid growing concern that the overuse of such drugs is contributing to rising numbers of life-threatening human infections from antibiotic-resistant bacteria known as "superbugs."… Veterinary use of antibiotics is legal…consumer advocates, public health experts and investors have become more critical of the practice of routinely feeding antibiotics to chickens, cattle and pigs…The bill…will restrict the regular use of antibiotics for disease prevention and bans antibiotic use to fatten up animals…aims to stop over-the-counter sale of antibiotics for livestock use…antibiotics would have to be ordered by a licensed veterinarian…California's Department of Food and Agriculture will be required to monitor antibiotic sales and use.

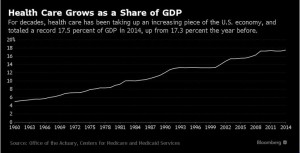

- Health Care in 2016: Eight Charts You Need to Follow the Sector (bloomberg.com)

Next (this) week bankers, investors, companies and researchers from around the world will gather in San Francisco for the J.P. Morgan Healthcare Conference, a massive gathering that sets the tone for the rest of the year. These are the charts that will help you keep up with the industry in 2016.

- Remember, You've had It Pretty Good

- Health Care Grows as a Share of GDP

- Are Obamacare's Gains Petering Out?

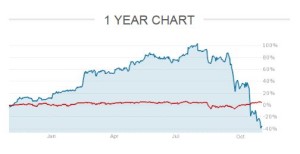

- Biotech, Insurers, Hospitals and Pharma All Gain Since 2010

- Venture Capital Investment Is at a Record

- Boom Years for Biotech

- The IPO Class of 2015

- Health Care's Big Deals

- Germany, U.S. in hot pursuit of ‘messenger’ drug molecules (newsdaily.com)

A molecule that carries the recipe for making drugs inside body cells is exciting scientists and investors alike, attracting hundreds of millions of dollars in a scramble for the next promising area of biotechnology… synthetic messenger RNA, or mRNA technology, a new approach to tackling a range of hard-to-treat diseases... In theory, the promise of mRNA is enormous, ranging from cancer to infectious diseases to heart and kidney disorders, since it could be used to tackle the 80 percent of proteins that are difficult to affect with existing medicines…In effect, mRNA serves as software that can be injected into the body to instruct ribosomes, the “3D-printers” found inside cells, to churn out desired proteins…This is a radically different approach from conventional approaches, where therapeutic proteins are produced outside the human body and…then be inserted back into the human body at great complexity and cost…“The field is moving very rapidly,”...“I predict it will have a significant impact.”...

- Valeant says Philidor pharmacy shutting down as it cuts ties (reuters.com)Valeant ditches Philidor (reuters.com)Kevin O'Leary on the Valeant controversy (reuters.com)

Valeant Pharmaceuticals International Inc, seeking to allay investor concerns about its business practices, said Friday it is cutting ties with a specialty pharmacy called Philidor Rx Services accused of helping it inflate revenue…The news failed to stem Valeant's sliding share price, which lost another 12 percent on Friday even after Bill Ackman…told investors the shares were "tremendously undervalued."…three top U.S. drug benefit managers...said they would no longer work with the pharmacy (Philidor). Express Scripts, CVS Health and OptumRx…said they made the decision after conducting audits of the pharmacy…Valeant shares have lost more than half their value since September as the company has come under attack on several fronts. U.S. prosecutors are also investigating the company over drug pricing…

- JPMorgan’s big health-care confab: What to expect (cnbc.com)What to watch at J.P. Morgan Health Care Conference (video.cnbc.com)

Exhausted. Depressed. These are the words biotech analysts and investors are using to describe their moods coming out of 2015. Which means this year's JPMorgan Health Care Conference, which kicks off next week, could take on a more muted tone than in previous years...Thousands of investors, analysts, executives and entrepreneurs head to San Francisco...for the conference, considered a barometer of sentiment across the industry as the year gets underway. More than 450 companies are slated to present to investors at the meeting...Sentiment will be weary, but not funeralesque...Normally, sentiment is extremely bullish at JPMorgan, but once every few years you get a situation like this...a 23 percent decline in biotech stocks from highs in July, driven by concerns over pressure on drug prices, valuations that have been rising for six years, and some stock-crushing clinical trial setbacks toward the end of the year. The Nasdaq biotechnology index sank 9.4 percent this week through Thursday…Despite the somber mood, 2015 wasn't as bad as it sounds. The Food and Drug Administration approved 45 new medicines, the most in 19 years. Deal activity was explosive, at more than 530 transactions worth more than $296 billion, according to MergerMarket, up 29 percent from 2014...It was also the sixth-straight year biotech outperformed the broader market...

- Big Pharma’s Shoes Don’t Fit Amgen (bloombergview.com)

The differences between biotech and pharma have always been a bit arbitrary. They mostly amount to whether the company name has been around for a century or mere decades, and whether there's a "gen" or a "zyne" in there somewhere…One thing investors like about Amgen is its most pharma-like attribute: For years, it was the only biotech to pay a dividend…But the company now risks adapting one of Big Pharma's less-desirable habits: expensive buyouts that risk large chunks of capital and investor goodwill…Amgen would be the latest in a trend of biotechs becoming buyers instead of…targets…Everyone's chasing the same shiny object…The road to every blockbuster drug is a minefield…Amgen's fear of missing out is understandable. But the very fastest way to derail a good thing is through big, bad acquisition. If Amgen wants to keep swinging $10 billion bats, it can't afford to miss.

- Express Scripts, CVS Health Cut Ties With Valeant’s Philidor Rx Pharmacy (forbes.com)

Some of the biggest customers of Philidor Rx, the consolidated specialty pharmacy tucked inside embattled drug giant Valeant Pharmaceuticals, are seeing red flags. Two of the nation’s biggest pharmacy benefits managers, CVS Health and Express Scripts, both said on Thursday they are cutting ties with Philidor Rx after finding the noncompliance with provider agreements…The terminations add a new headache to Valeant Pharmaceuticals as it tries to recover from an onslaught of scrutiny from lawmakers, regulators and investors into its business practices.