- Levaquin users slap J&J with $800M RICO suit, claiming pharma giant hid serious side effects (fiercepharma.com)

Johnson & Johnson is facing yet another lawsuit over its antibiotic Levaquin from people who claim that the company hid serious side effects. The latest legal action comes a couple of months after an FDA panel flagged serious problems associated with the entire class of antibiotics and voted to change the meds' labels...Five plaintiffs allege in a new suit that J&J and its Janssen unit deliberately mislabeled and misbranded Levaquin (levofloxacin), playing down harmful side effects for its own financial gain. The plaintiffs sued J&J and others--including former FDA commissioner Margaret Hamburg--under the federal Racketeer Influenced and Corrupt Organizations act, a law typically used to prosecute organized crime. "These concerted efforts resulted in significant harm and/or death to consumers of Levaquin, including plaintiffs," according to the suit...The plaintiffs are seeking more than $120 million in compensatory damages and more than $750 million in punitive damages to drive home "the seriousness of their egregious conduct and to deter similar conduct in the future."...The latest suit marks another chapter in J&J's Levaquin saga. The company has encountered thousands of lawsuits over the past several years from plaintiffs claiming that it did not adequately warn patients about the drug's dangers.

- These 10 S&P 500 Health Care Companies Are the Most Shareholder Friendly (thestreet.com)

Which health care companies have traditionally been the most shareholder friendly? Turns out Pfizer…is one of them. But what about the rest of the sector?...Health care companies have been actively returning capital to shareholders over the past 10 years, but not all of its sub-industries were active participants. However, that may change, particularly as several biotech companies start to mature…"Biotech has been increasingly active in repurchasing shares during the past five years,"…."We expect these trends to continue in the next several years, and we anticipate that more biotech companies will engage in similar capital deployment activities in the future as their businesses mature and they begin generating steady cash flows. Although we do not anticipate biotech to overtake the pharmaceutical industry."…So which health care companies have led the way with the most returned capital to shareholders over the past 10 years? Here's the list..

- Pfizer Inc.; Pharmaceuticals; YTD return: 3.3%; TRC 2005-2014: $127.37 billion

- Johnson & Johnson; Pharmaceuticals; YTD return: -2%; TRC 2005-2014: $108.4 billion

- Merck & Co. Inc.; Pharmaceuticals; YTD return: -4.7%; TRC 2005-2014: $68.1 billion

- Amgen Inc.; Biotech; YTD return: 0.39%; TRC 2005-2014: $39.56 billion

- United Health Group Inc.; Managed Health Care; YTD return: 11.7%; TRC 2005-2014: $36.27 billion

- HCA Holdings Inc.; Health Care Facilities; YTD return: -8.1%; TRC 2005-2014: $33.54 billion

- Abbott Laboratories; Health Care Equip ; YTD return: 2.2%; TRC 2005-2014: $33.16 billion

- Anthem Inc.; Managed Health Care; YTD return: 4.5%; TRC 2005-2014: $33.11 billion

- Bristol-Myers Squibb Co.; Pharmaceuticals; YTD return: 14.9%; TRC 2005-2014: $27.6 billion

- Medtronic Plc ; Health Care Equip ; YTD return: 4.7%; TRC 2005-2014: $24.4 billion

- Global 2000: The Biggest Drug Companies Of 2015 (forbes.com)

- Johnson & Johnson

- Pfizer

- Novartis

- Merck & Co.

- Roche Holding

- Sanofi

- Bayer

- GlaxoSmithKline

- Amgen

- McKesson

- Gilead Sciences

- Teva Pharmaceuticals Inds.

- AstraZeneca

- Abbott Laboratories

- Eli Lilly & Co.

- Back To School Grades For 24 Pharma And Biotech Giants (forbes.com)

…it’s time to dole out some grades to drug companies. …I give each company a letter grade, just like the ones you got in school. An A+ requires changing the face of medicine and making a ton of money. An F means a drug safety crisis and a financial failure – or a severe ethical breach. Everything else is in-between. I do not believe in grade inflation.

Top of the Class

- Regeneron Pharmaceuticals, Inc. ..... A-

- Valeant Pharmaceuticals ..... B+

- Gilead Sciences, Inc ..... B+

- Novo Nordisk ..... B

- Eli Lilly and Company ..... B

- Allergan plc ..... B

- Vertex Pharmaceuticals Incorporated ..... B

- Illumina ..... B

- Novartis ..... B

- Teva Pharmaceutical Industries ..... B-

- Sanofi ..... B-

- Celgene Corporation ..... B-

- Pfizer Inc. ..... B-

- Bristol-Myers Squibb ..... B-

- Alexion Pharmaceuticals, Inc. ..... B-

- Merck & Co., Inc. ..... B-

- Shire PLC Sponsored ADR ..... C+

- Roche Holding ..... C+

- Amgen Inc. ..... C+

- AbbVie, Inc. ..... C+

- Johnson & Johnson ..... C+

- GlaxoSmithKline ..... C

- Astrazeneca PLC Sponsored ADR ..... C

- Biogen Inc. ..... C

- Supreme Court declines to hear J&J appeal of Children’s Motrin lawsuit (statnews.com)

In a setback to the pharmaceutical industry, the US Supreme Court declined on Tuesday to hear an appeal sought by Johnson & Johnson of a $63 million verdict that found the company failed to properly warn consumers about the risks of its Children’s Motrin painkiller...At issue was whether J&J should have upgraded its product labeling to reflect the risk that a patient may develop toxic epidermal necrolysis, which can lead to a rare disease called Stevens-Johnson syndrome...J&J sought to convince the Supreme Court that federal law preempted the state court verdict. In response to a citizen’s petition seeking upgraded labeling, the Food and Drug Administration had agreed that an increased warning about skin reactions — such as rashes and blisters — was warranted. But the agency did not agree to add the names of the skin diseases…the company maintained it would have violated federal law if the Motrin labeling was updated with the sort of specific language the family believed should have been used, according to its filing with the Supreme Court...J&J complained it was in an untenable bind…J&J, which now faces a $140 million payout when including interest...is “disappointed the Supreme Court declined to hear this case because we believe it raises important and unsettled preemption issues.”

- J&J slapped with $1.75M verdict in Risperdal breast growth case (fiercepharma.com)Trial Evidence Indicates J&J Hid Risperdal Study Results From FDA (drugwatch.com)

Johnson & Johnson (Janssen Pharmaceuticals) lost another courtroom battle over claims that the company failed to warn doctors and patients that its antipsychotic drug Risperdal (risperidone) could cause breast growth in boys, a blow for the company as it continues to deal with related cases…state court jury in Philadelphia ordered J&J to pony up $1.75 million, including damages for disfigurement and mental anguish, to a young man who developed gynecomastia…while taking the drug as a teen…The company and its Janssen unit still face about 1,500 cases…

- Big Pharma teams up to defeat drug pricing proposal in California (fiercepharma.com)

California wants to cap drug prices, but Big Pharma isn't having it. Amid a growing backlash over drug pricing, companies such as Johnson & Johnson and Bristol-Myers Squibb are funneling millions of dollars into stamping out a new proposal that would curb drug spending in the state…other companies including Pfizer, Eisai, Purdue Pharma, The Medicines Co., Sunovion Pharmaceuticals and Daiichi Sankyo contributed to a fund that would quash a state ballot initiative…The initiative, dubbed the California Drug Price Relief Act, would only allow government health programs to strike contracts with drugmakers at prices that are the same or lower than those paid by the Department of Veterans Affairs, which usually gets steep discounts on meds from manufacturers…

- The top 10 pharma companies in social media (fiercepharmamarketing.com)

Chatting with the public is not in pharma's comfort zone. Drugmakers are adept at the one-way communication known as direct-to-consumer advertising, and some of them deal well with the media. Some even know how to work with patient groups. Back-and-forth with doctors? Pharma's daily bread...But put your average, everyday drug company in the middle of a public conversation, and it freezes up. Worried it will say the wrong thing, sensitive to criticism, mindful of unintended consequences, drugmakers usually prefer to stand by the punch bowl and check their iPhones for messages...You could say pharma has social anxiety...Drugmakers' usual excuse for remaining social-media wallflowers is regulation, or lack of it. The FDA's guidance on the subject is piecemeal and tardy; the agency has slapped companies for overstepping bounds they didn't know existed.

- J&J chalks up a win in first Tylenol liver-damage case to go to trial (fiercepharma.com)

Johnson & Johnson scored a victory in the first case to go to trial over claims that its blockbuster painkiller Tylenol (acetaminophen) causes liver damage and its dosing doesn't adequately account for the risk. A New Jersey jury ruled that the plaintiff did not prove that she took the painkiller… plaintiff …claims that she spent a week in the hospital for liver damage after accidentally overdosing on Extra Strength Tylenol…The news provides J&J/McNeil with an early win as it stares down about 220 lawsuits in state and federal court in New Jersey and Pennsylvania. The first federal trial is set for next year in Philadelphia, where about 200 of the cases are consolidated…

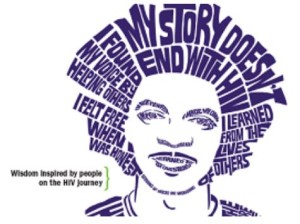

- Janssen’s latest Prezcobix effort taps HIV activists to curate patient-story contest (fiercepharmamarketing.com)

..HIV activists have signed onto Janssen's ongoing "Wisdom" campaign, headlining a share-your-story campaign for people living with the disease. The Johnson & Johnson unit will award up to $20,000 in charitable donations as part of the effort, which ties in the company's latest HIV brand, Prezcobix (darunavir and cobicistat)… Guy Anthony, Maria Mejia and Josh Robbins--all well-known activists for HIV/AIDS awareness and education--will write, videotape and post their wisdom on www.shareyourwisdom.com, and serve as advisors as the "Your Story. Your HIV Wisdom." campaign progresses.