- Supermarkets Again Dash Past CVS and Walgreens in 2022’s Part D Pharmacy Networks (drugchannels.net)

The Centers for Medicare & Medicaid Services has recently released its 2022 data on enrollment in Medicare Part D prescription drug plans. Our exclusive analysis of these numbers finds that for 2022, an astounding 99% of seniors are enrolled in the wonderland of PDPs with preferred pharmacy networks...For the second year, the big supermarket chains—Albertsons, Kroger, and Publix—outpaced the big three drugstore chains and Walmart...

READ MORE - Come for your drugs, leave with more shopping: Walmart’s new growth strategy? (reuters.com)

Walmart Inc’s efforts to develop closer ties with health insurer Humana Inc, which came to light...point to a brave new world of retail where superstores become healthcare centers offering basic medical care...They are also aimed at boosting Walmart’s slowing growth in brick-and-mortar store sales as it faces increasing pressure online from Amazon.com Inc. Deepening its existing partnership with Humana, or even acquiring the company outright, could be a step toward turning its 4,700 or so U.S. stores into healthcare centers that aim to attract more shoppers over 65...The end goal here is to get more people in their stores, get them to buy drugs and make an additional purchase while they are in the store...If Walmart can offer “competitive rates” on primary care and other health services...it “can grow traffic and push store visits.”...“It allows them to get ahead of everybody from warehouse club operators like Costco, Target and other retailers who run chain drugstores as well as food and drug combo operators like Kroger and Wegmans.”...

- Retail Pharmacy Clinics: Top Players and the Coming 2016 Pause (drugchannels.net)

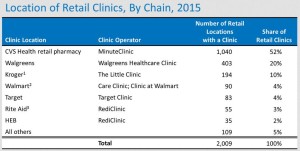

As low-cost generics come to dominate retail dispensing activity, clinics have emerged as a way for drugstores and other retail pharmacy outlets to diversify into non-dispensing revenues...There are now about 2,000 retail clinics. Below, I examine the chains with the biggest market share: CVS Health, HEB, Kroger, Rite Aid, Target, Walgreens, and Walmart...In 2015, the number of clinics grew slowly. In 2016, I project another year of slow growth as the big players retrench...

- CVS Health’s MinuteClinic remains the largest and fastest-growing retail clinic business, now operating more than half of all retail clinics.

- Walgreens is the second-largest retail clinic operator, with more than 400 Healthcare Clinics (formerly Take Care clinics). The number of clinics in Walgreens retail stores declined in 2015.

- Kroger has emerged as the third-largest retail clinic operator with its Little Clinic business, which operates inside nearly 200 Kroger, Dillon’s, Fry's, JayC, and King Soopers stores.

- Rite Aid changed its clinic strategy with the 2014 acquisition of RediClinic. As of January 2016, Rite Aid operated 41 RediClinics....a further 35 retail locations.. in HEB grocery stores...At 14 Rite Aid locations, the company leases space to other clinic operators...

- Walmart launched its own Care Clinics in 2014. There are now 17 Care Clinics in Walmart stores...Walmart also leases space to independently owned and operated Clinic at Walmart operators...operate inside 73 Walmart stores.

- With vaccines in more stores, pharmacies go on hiring spree (pharmacist.com)

Dozens of pharmacy chains and grocery stores with pharmacy counters are slated to start offering COVID-19 vaccinations this week, creating a wealth of employment opportunities. The companies are vying with one another—offering lucrative signing bonuses, in some cases—to hire established pharmacists, pharmacy technicians, student pharmacists, nurses, and other help. CVS Health is working toward 15,000 new vaccine-related hires, Walgreens has targeted 9,000, Kroger plans to recruit nearly 1,000 health care workers, and Rite Aid is looking to fill more than 2,000 pharmacy jobs...READ MORE

- Kroger May Be a Buyer for Walgreens, Rite Aid Stores (thestreet.com)

Shares of Kroger were lower Wednesday. The supermarket chain has emerged as a buyer for stores of Rite Aid. The drugstore chain is close to being acquired by Walgreens Boots Alliance, but Rite Aid would have to sell off overlapping assets in order to appease regulators. Kroger looks to be the potential buyer for all of Rite-Aid's overlapping stores considering that it is well capitalized and has experience running pharmacies in its stores.

- Walgreens, CVS Want Doctors’ Medicare Pay To Vaccinate (forbes.com)Patient Access to Pharmacists’ Care Coalition (pharmacistscare.org)

As the nation’s retail pharmacies move deeper into the business of providing healthcare services, they now want pharmacists to be paid by Medicare to immunize the nation’s seniors....Under legislation that is gaining rare bipartisan support and momentum in the House and Senate, particularly for a Congressional health bill, pharmacists would be paid to administer vaccines under Medicare part B...The pharmacies have formed a coalition known as “The Patient Access to Pharmacists’ Care Coalition,” to push for the legislation, known as the Pharmacy and Medically Underserved Areas of Enhancement Act (S. 314/H.R. 592). The coalition includes retailers and grocery store chains with pharmacies such as Walgreens Boots Alliance , CVS Health, Wal-Mart, Kroger, Rite-Aid and Target...It could bring in hundreds of millions of dollars to the drugstore industry given the growing business of providing vaccinations.

- Walgreens Boots Alliance’s plans $1 billion in cuts, stock drops (cnbc.com)

Walgreens Boots Alliance announced plans...to its cut annual costs by $1 billion within three years and reported first-quarter results that beat Wall Street’s estimates...The results also showed sales are struggling in Britain, one of its largest markets...Walgreens shares are down more than 2 percent this year bringing its market value to $69.3 billion. The stock has been under pressure as investors worry about the impact Amazon will have as it expands into the pharmacy business. To prepare for increased competition, Walgreens has announced partnerships with Kroger, Alphabet’s Verily and others...

- Six Retail Chains Now Dominate the Still-Booming 340B Contract Pharmacy Business (drugchannels.net)

The pharmacy industry’s role in the 340B Drug Pricing Program continues to expand...latest analysis finds that nearly 18,000 pharmacy locations contract with 340B-eligible covered entities. That accounts for more than one in four U.S. retail, mail, and specialty pharmacy locations...Walgreens remains the biggest player, with about the same number of locations as those of Walmart, CVS, Rite Aid, Kroger, and Albertsons combined...Amidst the contract pharmacy boom...what’s really going on. How many prescriptions do contract pharmacies provide at discounted prices to uninsured, underinsured, and low-income patients? Who is really benefiting from the contract pharmacy business?…a 340B contract pharmacy doesn’t earn traditional spreads and dispensing fees. They instead profit from fees paid by the 340B entity. Given providers’ substantial profit opportunities, a 340B entity can afford fees that often far exceed a pharmacy’s typical profits from dispensing a third-party-paid prescription...There are many other profit opportunities...The extensive use of 340B contract pharmacies allows hospitals and other providers to benefit from 340B drug discounts earned from commercially paid prescriptions dispensed by contract pharmacies...Do needy patients benefit? No one knows. Covered entities are not specifically obligated to share any 340B savings with financially needy or uninsured patents, nor are they required to disclose how they use profits from the 340B program...