- Industry paid $8.2B to docs, hospitals last year (biopharmadive.com)

Drug and device makers collectively made nearly $8.2 billion in payments to physicians and teaching hospitals in the U.S. last year, according to data made public by the Centers for Medicare and Medicaid Services last week...Payments for research made up more than half of the total, which also includes money given to doctors and hospitals for expenses like travel, gifts, speaking fees and meals. The $8.2 billion recorded last year was a notch higher than 2015's total and $320 million more than 2014's figure...Among the ranks of big pharma...Roche spent the most — a princely $586 million in payments. Novartis and Pfizer were close behind with more than $475 million each, although both made more research-related payments than Roche did...The data gives a snapshot of the enormous sums of money paid by the drug and device industries to doctors and hospitals. Most of the money goes towards research, payments for things like enrolling patients into new clinical studies or study implementation. Research payments can also include direct compensation to doctors…CMS began tracking payments in 2013 as part of changes to federal law through the Affordable Care Act, with 2016 marking the third full year of the program...

- Korea issues third set of punishments in Novartis bribery case (fiercepharma.com)

South Korean authorities aren’t letting Novartis off the hook easily in an ongoing bribery controversy. After a separate agency fined the drugmaker nearly $50 million over kickback payments in April, antitrust authorities in the country have just issued a new fine and complaint against the Swiss drug giant...South Korea’s Fair Trade Commission fined Novartis 500 million won ($445,000) and filed a new complaint over payments the company offered doctors between March 2011 and August 2016, according to the Korea Times...The developments come shortly after the country’s Ministry of Health & Welfare fined Novartis 55 billion Korean won—approximately $50 million—and suspended reimbursement of Exelon and Zometa for three months, alleging the company’s employees provided approximately $2.3 million in unlawful kickbacks…

- Greece’s corruption prosecutor quits, citing pressure over Novartis bribery probe (fiercepharma.com)

Novartis is embroiled in a soap opera in Greece, complete with bribery allegations and a suicide threat. Now the plot is thickening. The country’s chief corruption prosecutor, Eleni Raikou, has resigned—and she’s blaming the Swiss pharma giant’s legal issues for her decision...Raikou...sending a letter to Greece’s Supreme Court claiming she was targeted by "unofficial power centres" over her investigation of Novartis...Greek authorities raided Novartis’ offices...after one of the company’s local managers reportedly made a suicide threat...The executive was one of the employees the authorities were interviewing...The probe began after media reports appeared alleging that Novartis had paid bribes to local "functionaries,"…Raikou’s resignation letter said that the bribery probe turned up "substantial and crucial evidence" that doctors and some politicians in Greece had received €28 million ($30.4 million) worth of bribes from a Novartis bank account...some of the evidence was linked to the prosecution of a local businessman and former minister of defense Yiannos Papantoniou...

- Supreme Court urged to weigh in on six-month biosimilar delays (fiercepharma.com)

Novartis’ Sandoz unit has been marketing Zarxio, its biosimilar version of Amgen’s blockbuster drug Neupogen, for more than a year, but the drug is still tangled in a patent fight that boils down to one central question: Should biosimilar makers have to give six months' notice to the original drugmaker after they receive FDA approval for their copycat version? The answer will affect not only Novartis and Amgen, but any company seeking to make a biosimilar product…The U.S. Solicitor General...asked the Supreme Court to interpret the 2009 law that originally laid out the proper procedure for seeking FDA approval for biosimilar drugs.

- Google bets on European biotech drugs, backs new fund (reuters.com)

Google is betting on the potential of European biotech companies to deliver life-changing drugs by investing alongside Swiss company Novartis in a new $300 million fund run by leading life sciences investment firm Medicxi...The move shows Google casting an increasingly wide net as it pumps cash into global medical research, seeding what it believes will become a core long-term healthcare business...The new fund will back both private and public firms with products that have already reached mid-stage Phase II clinical development, providing them with a new source of growth capital...There is a funding gap because there is a maturing class of biotechnology companies now in Europe...Europe boasts world-class universities and scientists, but its biotechnology sector has long been a poor relation to the bigger U.S. industry, where emerging life sciences firms are able to access a much deeper pool of capital...By providing funds for late-stage drug development, the hope is that more firms will be able to stay independent and continue to build up the value of their experimental medicines, rather than selling out prematurely to larger players...

- Remedy for Threat to US Pharmaceutical Industry’s Profitability (forbes.com)

US pharmaceutical companies...are...very vulnerable to increasing political pressure from the Trump Administration. The good news is there are actions these companies can take…

- Pharma’s Vulnerability - Small number of US jobs vs. large US revenues...pharma companies’ largest market and largest profit pool is the US. But only a small percentage of the jobs it offers are in the US. The Trump Administration has already been vocal about returning jobs to the US...Pharmaceutical companies have taken full advantage of offshoring...The Administration can apply pricing pressure in the US, to get these companies to commit to move work back from offshore…

- What Can Pharmaceutical Companies Do In The Face Of This Pressure?...pharmaceutical firms will need to demonstrate substantial job growth in the US...this (is) possible without destroying their margins...Disruptive digital technologies and capabilities are now mature enough to allow them to migrate work from the traditional low-cost labor locations to the US into far more efficient, automated, digital processes.

- The top 10 drug launches of 2017 (fiercepharma.com)

- After an unusually slow year for new drug approvals—the FDA greenlighted just 22 meds in 2016—it remains to be seen whether drugmakers can do much better in 2017. One thing’s for sure, though: No matter what total the industry tallies up this year, the crop will bring some would-be blockbusters and market disrupters.

At the top of the list...is Ocrevus (ocrelizumab), the Roche multiple sclerosis drug that’s promising to shake things up in more ways than one...

Sanofi and Regeneron hot-shot Dupixent (dupilumab) could make a big splash in severe atopic dermatitis, assuming payers don’t get in the companies’ way.

Ditto for Biogen's Spinraza, which in December became the first FDA-approved product to treat spinal muscular atrophy—but whose high sticker could raise eyebrows at a time when U.S. President Donald Trump is threatening pricing action.

Tesaro and Neurocrine are looking for their first-ever FDA approvals, in breast cancer pill niraparib and tardive dyskinesia therapy Ingrezza, respectively.

...Kite Pharma is aiming to get the first-ever CAR-T cancer drug to market, with a candidate, KTE-C19, that the oncology community will be watching closely as the next big thing in immunotherapies.

Novartis’ ribociclib...which aims to challenge Pfizer’s Ibrance in the CDK 4/6 breast cancer space.

...semaglutide, Novo Nordisk's weekly GLP-1 drug, a would-be successor to the company's blockbuster Victoza…

- After an unusually slow year for new drug approvals—the FDA greenlighted just 22 meds in 2016—it remains to be seen whether drugmakers can do much better in 2017. One thing’s for sure, though: No matter what total the industry tallies up this year, the crop will bring some would-be blockbusters and market disrupters.

- Supreme Court speeds copycat biologic drugs to market (reuters.com)

The decision has major implications for the pharmaceutical industry because it will dictate how long brand-name makers of biologic drugs can keep near-copies, called biosimilars, off the market. Even the six months at issue in the case can mean hundreds of millions of dollars in sales...Health insurers expect biosimilars to be cheaper than original brands, like generics, saving consumers billions of dollars each year...Novartis said in a statement that the ruling "will help expedite patient access to life-enhancing treatments."...Amgen spokeswoman Kelley Davenport said the company was disappointed but "will continue to seek to enforce our intellectual property against those parties that infringe upon our rights."...The companies disagreed on how to apply that law's requirement that a biosimilar drug maker give the brand-name manufacturer 180 days notice before launching its copycat version...In July 2015, the appeals court ruled that the 180-day notice must be given after FDA approval, a ruling the Supreme Court reversed...Writing for the court, Justice Clarence Thomas said that the decision was not based on policy arguments, but rather, the "plain language" of the biosimilar law itself...

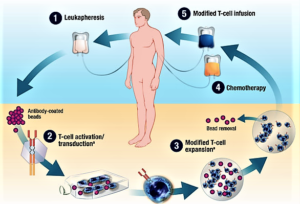

- The First CAR-T Drugs Have Left the Gate (fool.com)

Investors should keep an eye on this promising way to treat cancer...For all the talk about biotechs being nimble, it's a big pharma that looks like it'll be the first company to launch a chimeric antigen receptor T-cell (CAR-T) product...Novartis announced last week that the Food and Drug Administration accepted its application to market tisagenlecleucel-T...in patients with B-cell acute lymphoblastic leukemia who are relapsed and refractory to other therapies...A few days later, Kite Pharma completed its application for axicabtagene ciloleucel...Kite's application could be accepted early, putting it less than two months behind Novartis…Since CAR-T therapies are personalized treatments that have to be made individually for each patient, they're likely to be expensive to produce and therefore require a premium price. The first company to get a CAR-T therapy approved will set the price, which later companies may have to match unless they can justify a higher price with higher efficacy...With prices that will probably exceed those of current cancer treatments, investors should expect some pushback from insurers. One way Novarits and Kite can get around the cost issue is by offering money-back guarantees...Kite's and Novartis' CAR-T therapies are just the tip of the iceberg for this new way to treat cancer...

- With billions at stake, will biosims finally make a mark in the U.S. in 2017? (fiercepharma.com)

Biosimilars have already taken hold in Europe, with Celltrion's Remicade copy, for one, wreaking havoc on the branded med's sales. Whether they'll finally make their mark in the U.S., though, remains to be seen—and 2017 could be the year we find out...Over the next several years, billions of dollars in legacy drug sales could be ceded to an oncoming and rising wave of biosimilars, with much of the action set to kick off in 2017. All told, 7 of biopharma’s top 10 best-selling drugs next year face a near-term biosim threat, meaning fortunes will be made or lost as the field continues to take shape...Fundamental legal questions also remain surrounding biosims in the U.S...whether the biosimilar pathway will survive...a potential Affordable Care Act repeal...the Supreme Court will likely review the “patent dance clauses which are currently optional.” That could potentially throw a wrench in future launches...