- Merrill Lynch 4 Top Pharmaceutical Dividend Stocks To Own For 2016 (247wallst.com)4 Biopharma and Pharmaceutical Stocks With Game-Changing Catalysts Coming (247wallst.com)

Despite the howling from political candidates trying to make the top drug-makers their whipping boy in populist campaign efforts, the need and demand for pharmaceuticals will only continue. This is especially the case when you consider that we now live in a world with an aging population that is going to be popping more and more doctor-prescribed pills…While pricing and cost concerns won’t go away completely until the election cycle winds down, now may be an ideal time to add the top yielding stocks to portfolios for 2016…The companies we found have long histories of paying and raising their dividends, and make good sense for conservative growth and income portfolios.

- Abbott Lab

- Eli Lilly

- Merck & Co.

- Pfizer

- Pfizer and Allergan to approve $150B merger (cnbc.com)

Pfizer was due to secure formal board approval on Sunday for its acquisition of Botox maker Allergan for more than $150 billion, making it the healthcare sector's largest deal ever...The deal would involve Pfizer paying with 11.3 of its shares for each Allergan share...There will also be a small cash component, accounting for less than 10 percent of the value of the deal...Pfizer's Chief Executive Ian Read…will be CEO of the combined company, with Allergan's CEO Brent Saunders…serving in a very senior role focused on operations and the integration…It would be the biggest merger of the year, topping beer maker Anheuser-Busch InBev's proposed $107 billion takeover of SABMiller Plc. And it would realize Read's longtime ambition of an "inversion" deal that would get Pfizer out from under the 35 percent U.S. corporate tax rate, among the world's highest. The tax rate in Ireland is 12.5 percent…U.S. Treasury last year, and again last week, updated its rules on inversions to make it harder for companies to avoid U.S taxes by moving overseas. But experts have said these moves would do little to prevent Pfizer from inverting.

- GSK and Pfizer team up on continuous manufacturing project (in-pharmatechnologist.com)Pfizer, GEA Pharma Systems, and G-CON Manufacturing unveil a modular manufacturing prototype that runs continuously and can quickly deliver customized quantities of drugs. (automationworld.com)

Pfizer and GlaxoSmithKline have agreed to work together on the development of a new version of the former's continuous processing technology for oral solid dosage drugs...Pfizer's portable, continuous, miniature and modular (PCMM) system...is designed to break away from the conventional batch manufacturing model used in pharma and towards continuous manufacturing…In continuous manufacturing, drugs are continuously produced in highly-automated, closed units that allow changes to the production parameters on the fly…The approach only allows production to be tweaked if quality issues emerge - avoiding the need to lose an entire batch - and also ties in with the shift towards flexible manufacturing of smaller volumes for specialised applications, such as personalised medicines…Pfizer developed the first generation of its PCMM system along with GEA and G-CON, and describes it as "an autonomous and transportable pod that may be quickly shipped from location to location and readily brought online to create a fully functional module."…it takes around a year to set up, compared to two or three years for conventional production lines.

- State of Nevada makes $3.8 million available to School of Medicine for research projects to improve women’s health (medicine.nevada.edu)

Through a settlement brokered by the State of Nevada Attorney General's Office, approximately $3.8 million is available to the University of Nevada School of Medicine for research projects aimed at improving women's health in Nevada…The State of Nevada obtained the settlement with pharmaceutical companies Wyeth, Pfizer and Pharmacia & Upjohn relating to claims regarding postmenopausal hormone therapy products…The funds will be distributed by the Attorney General's Office over a five-year period ending in 2019, with half the available research funds going to School of Medicine faculty in Reno and Las Vegas and the other half going to University Medical Center of Southern Nevada.

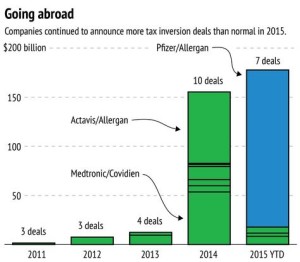

- Data: Tax inversions still going strong as M&A weakens (cnbc.com)

Pfizer's record-setting proposed purchase of Allergan for about $160 billion will not only be the biggest health-care sector deal ever, it will also be one of the largest tax inversions in recent history…Tax inversions...are frowned upon by politicians and the Treasury Department. But efforts to penalize companies for making such deals seem to be falling flat…Tax inversions are a better deal for companies that already have substantial sales abroad, or (like pharmaceuticals) rely on high-margin businesses based on intellectual property…while inversions have continued at an unusually high rate, overall merger and acquisition activity has been slowing…By value, U.S. inversion deals accounted for about 4 percent of global M&A activity in 2014 and 2015 — up from 2 percent or less in the three years before that…It remains to be seen whether Treasury Department rules meant to prevent tax inversions will have an impact. The regulations do not apply to the Pfizer deal, which will result in a company with about 56 percent ownership in the U.S. — the rules only apply to companies with 60 percent or higher.

- Why Inversion Deals Are All the Rage in Health Care (bloomberg.com)

Marshall Sonenshine, Sonenshine Partners chairman, comments on Pfizer possibly being in advanced talks to buy Allergan for as much as $380 per share. He speaks with Bloomberg's Betty Liu on "Bloomberg Markets."

- Pfizer expands eligibility for RxPathways patient assistance programs (drugstorenews.com)

Pfizer is looking to help more patients afford medication, announcing… that it would be expanding eligibility for its RxPathways program, which offers services to help patients access medication. The change makes patients who earn up to four times the federal poverty level based on family size (up to $97,000 for a family of four) eligible for some of the 40 medicines offered for free by the program…“We have listened to patients and acted quickly to significantly expand the eligibility of our patient assistance programs. While patient assistance is not a permanent solution, it is a necessary step for helping to solve some of the high co-pay issues that some patients face,”…

- A Head Fake From the Taxman (bloomberg.com)

Allergan shareholders got all riled up for nothing…Shares of the Botox maker sank 2.8 percent on Thursday as fears that the U.S. Treasury Department was about to get tougher on inversions outweighed the news that Pfizer was preparing a nearly $200 billion bid for the company. The department's new guidelines -- announced after the market close -- turned out not to be such a body blow after all…the proposed changes just fine tune the steps already taken by the Treasury last year to make it harder and less appealing for companies to use acquisitions that move their legal address abroad for tax benefits. There was nothing groundbreaking -- and most importantly, nothing that should significantly derail a Pfizer inversion…Cue Allergan shares making up their losses and then some on Friday…The latest guidelines do make it incrementally harder to structure inversions and remove some economic benefits, but the handicaps only apply to transactions in which the U.S. company's investors wind up with between 60 percent and 80 percent of the combined entity. Pfizer already knew that was dangerous territory; those were the types of inversions targeted by the Treasury last year. By structuring its Allergan purchase as an all-stock deal with a high premium, Pfizer could be able to skirt the tougher rules.

- After big spending and hard lobbying, Pfizer eyes new tax home (finance.yahoo.com)Pfizer-Allergan deal would set up U.S. company for a split (finance.yahoo.com)

Pfizer Chief Executive Ian Read, who has been lobbying Congress regularly for a corporate tax cut, is trying for the second time in as many years to do a deal with a foreign company that could produce the savings he has been unable to extract from Washington…Pfizer Inc, which is pursuing a deal for Dublin-based Allergan Plc, was one of the top spenders among pharmaceutical companies lobbying the…government…Pfizer spent $9.49 million on lobbying in 2014 and $10.1 million on lobbying in 2013…Pfizer appears to have stopped waiting for Congress to act."I don't think they are giving up, I think they are just dealing with the world as it is...Investment in cures and patients don't follow a political calendar, they follow a scientific calendar,"…

- Pfizer partners with South Africa to produce pneumococcal vaccine (reuters.com)

Pfizer has partnered with South Africa's Biovac Institute to produce a potentially life-saving pneumonia vaccine for infants…The five-year partnership…will see technology transfer and skills upgraded for the production of 'Prevenar 13' vaccine on a sustainable basis…There is more that we can do to cut the costs of the vaccine, and that is to manufacture the vaccine here in Cape Town…vaccine prices have sky-rocketed over the last decade...