- Six Retail Chains Now Dominate the Still-Booming 340B Contract Pharmacy Business (drugchannels.net)

The pharmacy industry’s role in the 340B Drug Pricing Program continues to expand...latest analysis finds that nearly 18,000 pharmacy locations contract with 340B-eligible covered entities. That accounts for more than one in four U.S. retail, mail, and specialty pharmacy locations...Walgreens remains the biggest player, with about the same number of locations as those of Walmart, CVS, Rite Aid, Kroger, and Albertsons combined...Amidst the contract pharmacy boom...what’s really going on. How many prescriptions do contract pharmacies provide at discounted prices to uninsured, underinsured, and low-income patients? Who is really benefiting from the contract pharmacy business?…a 340B contract pharmacy doesn’t earn traditional spreads and dispensing fees. They instead profit from fees paid by the 340B entity. Given providers’ substantial profit opportunities, a 340B entity can afford fees that often far exceed a pharmacy’s typical profits from dispensing a third-party-paid prescription...There are many other profit opportunities...The extensive use of 340B contract pharmacies allows hospitals and other providers to benefit from 340B drug discounts earned from commercially paid prescriptions dispensed by contract pharmacies...Do needy patients benefit? No one knows. Covered entities are not specifically obligated to share any 340B savings with financially needy or uninsured patents, nor are they required to disclose how they use profits from the 340B program...

- Retail Pharmacy Clinics: Top Players and the Coming 2016 Pause (drugchannels.net)

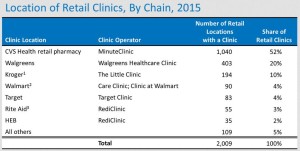

As low-cost generics come to dominate retail dispensing activity, clinics have emerged as a way for drugstores and other retail pharmacy outlets to diversify into non-dispensing revenues...There are now about 2,000 retail clinics. Below, I examine the chains with the biggest market share: CVS Health, HEB, Kroger, Rite Aid, Target, Walgreens, and Walmart...In 2015, the number of clinics grew slowly. In 2016, I project another year of slow growth as the big players retrench...

- CVS Health’s MinuteClinic remains the largest and fastest-growing retail clinic business, now operating more than half of all retail clinics.

- Walgreens is the second-largest retail clinic operator, with more than 400 Healthcare Clinics (formerly Take Care clinics). The number of clinics in Walgreens retail stores declined in 2015.

- Kroger has emerged as the third-largest retail clinic operator with its Little Clinic business, which operates inside nearly 200 Kroger, Dillon’s, Fry's, JayC, and King Soopers stores.

- Rite Aid changed its clinic strategy with the 2014 acquisition of RediClinic. As of January 2016, Rite Aid operated 41 RediClinics....a further 35 retail locations.. in HEB grocery stores...At 14 Rite Aid locations, the company leases space to other clinic operators...

- Walmart launched its own Care Clinics in 2014. There are now 17 Care Clinics in Walmart stores...Walmart also leases space to independently owned and operated Clinic at Walmart operators...operate inside 73 Walmart stores.

- HHS partners with pharmacies to enroll more people in ObamaCare (pharmacist.com)HHS partners with nation’s largest pharmacies to promote Health Insurance Marketplace (hhs.gov)

Partners represent more than 38,000 pharmacies across the country...Department of Health & Human Services announced that it is partnering with pharmacies across the United States in an effort to sign up more individuals for ObamaCare health coverage for 2016 as the deadline fast approaches...Participating pharmacies, including CVS Health, Good Neighbor Pharmacy, Thrifty White, Rite Aid, and Walgreens, will make people aware of health insurance options through the online health insurance marketplace...Participating pharmacies will have trained enrollment personnel available to work directly with consumers in the stores. Pharmacies will also host local enrollment events and distribute educational resources about their health insurance options through the online marketplace...

- Walgreens Boots Alliance to Buy Rite Aid for $17.2 Billion (bloomberg.com)Walgreens’ Q4 profit beats Street; yearly sales top $103 billion (drugstorenews.com)

Walgreens Boots Alliance Inc. agreed to acquire Rite Aid Corp. for about $9.4 billion in cash… The…deal…would combine the second- and third-largest drugstore chains in the U.S., with a total of about 12,800 locations, helping Walgreens vault past market leader CVS Health Corp. The acquisition will… will produce more than $1 billion in savings from cost overlaps…the deal is valued at $17.2 billion… Rite Aid shares fell 8.1 percent to $7.97 at 9:55 a.m. in New York, below Walgreens’ offer of $9 a share, reflecting speculation that the transaction will face antitrust scrutiny…Walgreens shares slumped 6.6 percent to $88.90. The deal creates financial savings but does little to change the drugstore chain’s strategic position in the rapidly evolving health-care industry…

- Rite Aid improves distribution in Southeast with new DC (drugstorenews.com)

Rite Aid announced...the grand opening of its new distribution center in Spartanburg, S.C....first in 16 years," stated John Standley, Rite Aid chairman and CEO. "Featuring highly efficient and advanced technologies, this facility will play a crucial role in our company’s supply chain, supporting more than 1,000 Rite Aid stores across the southeastern United States, and help us deliver a superior customer experience."...approximately 600 new jobs...will have a tremendous impact on the entire state and is a testament to the competitive business environment...The 900,000 square foot distribution center sits on 97 acres...Some of the features of the new facility include:

- High efficiency LED and T5 fluorescent light fixtures and occupancy sensor controlled warehouse lighting;

- An on-site truck maintenance facility, including a fueling station, trailer weigh scale and wash area;

- High-speed automated palletizers, ergonomically designed manual palletizing stations and automatic label applicators;

- State-of-the-art warehouse and labor management system;

- Voice pick technology; and

- 60,000 square feet of office space, including an associate cafeteria, fitness center and other amenities.

- The Top 15 Pharmacies of 2015 (drugchannels.net)Largest U.S. Pharmacies Ranked by Total Prescription Revenues, 2015 (pembrokeconsulting.com)

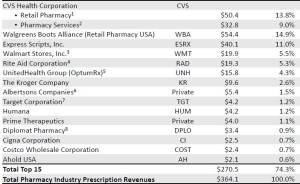

Next week, Drug Channels Institute will release our updated, revised, and expanded 2016 Economic Report on Retail, Mail, and Specialty Pharmacies...provides a sneak peek at the largest pharmacies, ranked by total U.S. prescription dispensing revenues for calendar year 2015…We estimate that total revenues of retail, mail, and specialty pharmacies reached $364.1 billion in 2015, up 12.1% from 2014. The top tier of dispensing pharmacies—CVS Health, Walgreens Boots Alliance, Express Scripts, Walmart, Rite Aid, and UnitedHealth Group’s OptumRx—accounted for about 64% of U.S. prescription dispensing revenues in 2015...many of the largest pharmacies are now central-fill, mail and specialty pharmacies operated by such PBMs and payers as Express Scripts, Caremark, and UnitedHealth. This reflects the growing role of specialty drugs in the pharmacy industry. We estimate that specialty drugs account for 35% or more of revenues at these pharmacies.

- WBA to divest as many as 1,000 stores to secure Rite Aid deal approval (drugstorenews.com)

The merger agreement between Walgreens Boots Alliance and Rite Aid must be consummated by Oct. 27, 2016, or the deal is off, according to documents filed to the Securities and Exchange Commission on Thursday…If Rite Aid walks away from the deal at any time, Rite Aid will forfeit a $325 million termination fee to Walgreens. Rite Aid may also be required to pay up to an additional $45 million to cover expenses incurred by Walgreens…Conversely, Walgreens will forfeit $325 million to Rite Aid if it's not able to secure regulatory approval of the deal, a figure that could double to $650 million if Walgreens "enters into, consummates or announces certain acquisitions within eight to 12 months of the date of the merger agreement…Walgreens is willing to divest as many as 1,000 locations, or other holdings not to exceed an aggregate value of $100 million, in an effort to secure approval of the acquisition..

- Pricing Power – Big pharmacies are dismantling the industry that keeps US drug costs even sort-of under control (qz.com)

When US lawmakers convened a hearing last month to discuss the pricing of prescription drugs, it was the testimony of Martin Shkreli...that garnered the headlines. But the hearing also looked at an issue that...could make drugs more expensive for far more people…The impetus was October’s announcement from Walgreens...that it was buying Rite Aid...Critics said that would create a drugstore duopoly with CVS, the market leader. They didn’t, however, look as hard at another effect of the deal, which likely will bring about the final collapse of the industry tasked with keeping prescription-drug costs under control...Buried inside Rite Aid is a bundle of pharmacy benefit managers...Walgreens says that acquiring Rite Aid’s PBMs would help it compete with arch-rival CVS, which controls a large and extremely profitable PBM called Caremark...combining pharmacies and PBMs under one roof creates a conflict of interest. It can restrict patients’ access to certain prescription drugs, and can prevent independent drugstores from competing fairly for new customers...As "competition decreases,"..."prices are going to increase. That’s what we’re finding now." If Walgreens successfully acquires Rite Aid and its PBMs, one of the industry’s last remaining constraints on drug prices will disappear.

- Walgreens, CVS Want Doctors’ Medicare Pay To Vaccinate (forbes.com)Patient Access to Pharmacists’ Care Coalition (pharmacistscare.org)

As the nation’s retail pharmacies move deeper into the business of providing healthcare services, they now want pharmacists to be paid by Medicare to immunize the nation’s seniors....Under legislation that is gaining rare bipartisan support and momentum in the House and Senate, particularly for a Congressional health bill, pharmacists would be paid to administer vaccines under Medicare part B...The pharmacies have formed a coalition known as “The Patient Access to Pharmacists’ Care Coalition,” to push for the legislation, known as the Pharmacy and Medically Underserved Areas of Enhancement Act (S. 314/H.R. 592). The coalition includes retailers and grocery store chains with pharmacies such as Walgreens Boots Alliance , CVS Health, Wal-Mart, Kroger, Rite-Aid and Target...It could bring in hundreds of millions of dollars to the drugstore industry given the growing business of providing vaccinations.

- The Walgreens-Rite Aid Deal: Ten Things You Should Know (drugchannels.net)

Wow. Walgreens Boots Alliance is acquiring Rite Aid. As I told The New York Times: “The pharmacy consolidation endgame has begun.”…Given the consumer angle, the deal has been widely covered.

Here are two significant news reports that outline the transaction’s high points:

- Walgreens to Buy Rite Aid for $9.4 Billion in The New York Times

- Walgreens, Rite Aid Unite to Create Drugstore Giant in The Wall Street Journal

..here are the surprisingly skimpy official company documents:

- Press release…

- Fiscal year end 2015 and 4Q earnings conference call (See page 19.)

The deal was not a total surprise. In April, I asked Will Walgreens Boots Alliance Buy Rite Aid?

- WBA is doubling down on retail pharmacy.

- Surprisingly, WBA is claiming that mega-scale with payers did not drive the deal.

- Envision Rx is a learning opportunity, not a strategic driver.

- The FTC will approve the deal.

- The deal adds even more complexity and opacity to WBA.

- It’s good for AmerisourceBergen, but horrible for McKesson.

- Wholesaler outsourcing will make integration easier.

- WBA will (probably) proceed with its ABC warrants.

- All hail our global channels overlord.

- Big deals beget more deals.