- Half of Europe’s clinical trials fail to report results despite EU rule (reuters.com)

Almost half of all European-registered clinical trials - in which scientists test drug treatments, interventions or therapies in humans - have breached EU rules by failing to report results...The analysis also found that while most major pharmaceutical companies are coming close to complying with EU reporting rules for trials in people, most major academic institutes are not...European Union guidelines say that funders of clinical trials must ensure all studies entered on the EU Clinical Trials Register since 2004 have posted results there within a year of concluding...Advocates for transparency in science say enforcing the rule is necessary to ensure researchers do not bury results they consider unfavorable...We cannot make informed choices about which treatments work best, as doctors and patients, unless all results are reported...

- Billion-dollar babies (economist.com)

The high cost of R&D is used to explain why drugs giants merge, and why they must charge high prices. The reality is somewhat different…Pfizer’s boss, put it, the merger will create “a leading global pharmaceutical company with the strength to research, discover and deliver more medicines and therapies to more people around the world.”…the common suggestion that size is needed to create a research-driven powerhouse does not stack up…the industry is…moving away from a model in which giant firms throw huge sums at in-house research in a quest for ground-breaking new treatments… rather than spending heavily in many different areas of cutting-edge research, the largest firms are increasingly buying in drugs that are already in the course of development. In some cases they do so by buying other established firms…the drugs giants are buying smaller, younger biotechnology firms which focus on a single-treatment approach…in the past 20 years those drug companies that consistently did well in various therapeutic areas were earning more than 70% of their sales from products developed elsewhere.

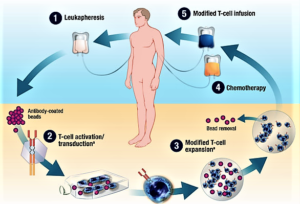

- The First CAR-T Drugs Have Left the Gate (fool.com)

Investors should keep an eye on this promising way to treat cancer...For all the talk about biotechs being nimble, it's a big pharma that looks like it'll be the first company to launch a chimeric antigen receptor T-cell (CAR-T) product...Novartis announced last week that the Food and Drug Administration accepted its application to market tisagenlecleucel-T...in patients with B-cell acute lymphoblastic leukemia who are relapsed and refractory to other therapies...A few days later, Kite Pharma completed its application for axicabtagene ciloleucel...Kite's application could be accepted early, putting it less than two months behind Novartis…Since CAR-T therapies are personalized treatments that have to be made individually for each patient, they're likely to be expensive to produce and therefore require a premium price. The first company to get a CAR-T therapy approved will set the price, which later companies may have to match unless they can justify a higher price with higher efficacy...With prices that will probably exceed those of current cancer treatments, investors should expect some pushback from insurers. One way Novarits and Kite can get around the cost issue is by offering money-back guarantees...Kite's and Novartis' CAR-T therapies are just the tip of the iceberg for this new way to treat cancer...

- Specialty Pharmaceuticals for Hyperlipidemia — Impact on Insurance Premiums (nejm.org)

PCSK9 inhibitors…offer the promise of reductions in blood cholesterol levels…This broad indication sets the practice of cardiology on a collision course with specialty pharmaceutical pricing models…reserved for drugs that benefited relatively limited patient populations…these therapies may also lead to savings down the road, by reducing rates of cardiovascular events…There will surely be formal economic evaluations of these data, and there are long-term outcome studies under way to elucidate the potential effect of these therapies on cardiovascular event rates…it is apparent that the prices for these drugs will result in net costs to the health care system, even if they may eventually be found to offer good value for the money…expected total annual costs in the billions, it's important to ask who will bear these costs...Pricing pressure on innovative products would drive a fundamental restructuring of the industry and further increase the financial challenges of bringing scientific innovations to the market. It is important that we manage these downside risks carefully as we work toward a more sustainable pricing model in this market..

- This startup is using tech to make animal testing in clinical trials more ethical (medcitynews.com)

Dog as man’s best friend...Now a small startup in Philadelphia is making the saying applicable to the pharmaceutical and drug development world...Drugs that are developed by pharmaceutical companies are...tested first in animals to evaluate their safety and how they interact with living tissue. But the typical testing method is to take a healthy animal, give them a certain disease, test the drug, therapy, or medical device, and then kill them...The One Health Company is trying something new by finding dogs (and cats) with naturally occurring diseases that are also present in humans, like bone cancer, and testing new drugs or therapies on them. The goal is two-fold: Provide pro-bono care for pet owners to heal their own pets, while facilitating bringing new drugs to market by collecting data for pharmaceutical companies...The...approach...is notably different. Pets remain with their families, diseases are never induced, and putting a pet down is never considered an option in any of their clinical trials. Families caring for their sick pets as they undergo these trials collect data, via smartphone, on their pets’ behavior and habits using proprietary clinical trial management software...

- Reducing LDL with PCSK9 Inhibitors — The Clinical Benefit of Lipid Drugs (nejm.org)

…Endocrinologic and Metabolic Drugs Advisory Committee of the Food and Drug Administration…met to consider marketing applications for the new molecular entities alirocumab (Praluent) and evolocumab (Repatha)on the basis of their ability to lower low-density lipoprotein cholesterol levels…These first-in-class medications are fully humanized monoclonal antibodies that inactivate proprotein convertase subtilisin–kexin type 9…consequent lowering of LDL cholesterol levels…has led to optimism regarding the potential — but as yet unproven — cardiovascular benefits…LDL cholesterol reduction as the surrogate measure of clinical benefit. No efficacy data on cardiovascular outcomes were provided…Establishing evidence of improved cardiovascular outcomes is key to evaluating medications from any new drug class intended to reduce such risk….definitive evidence of reduced cardiovascular event rates is essential…to provide such evidence should elucidate the medications' true clinical benefits and possible risks.